Roadmap to Sustainable Finance: A Bibliometric Analysis of Socially Responsible Investment in Financial Institutions

Abstract

Abstract Views: 0

Abstract Views: 0

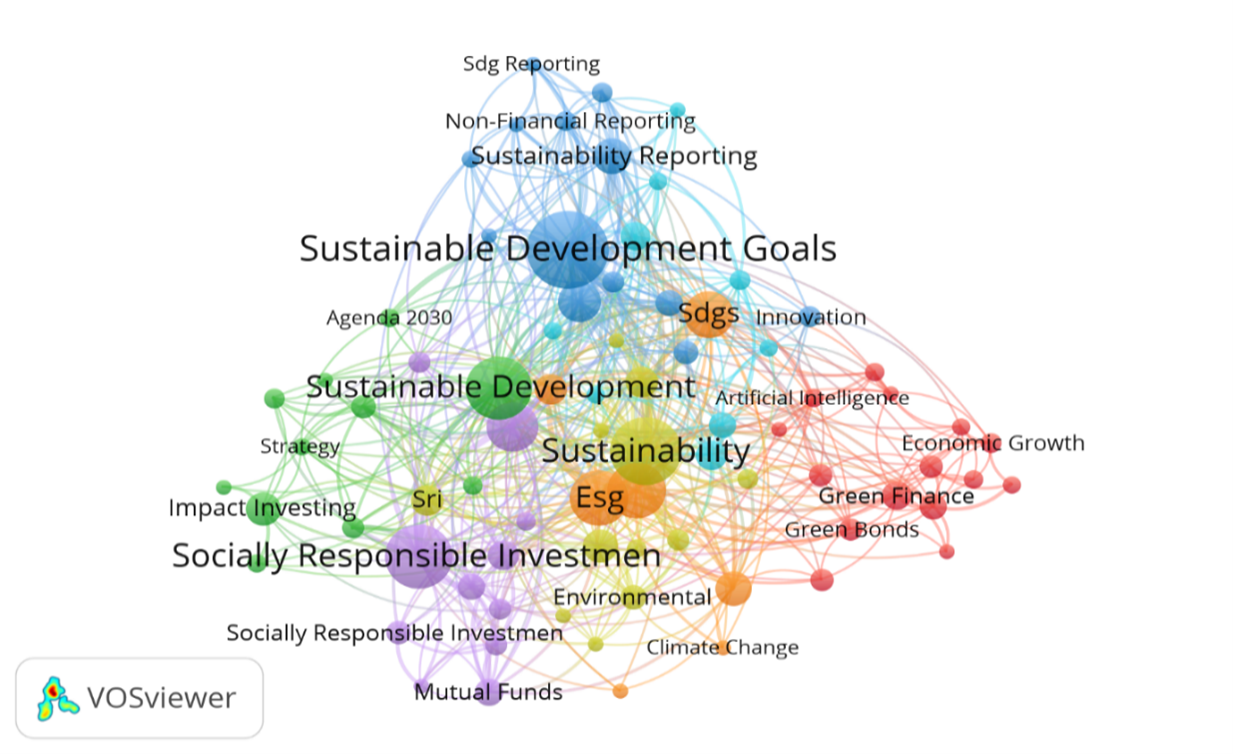

The current study aims to examine the role of Socially Responsible Investment (SRI) in Financial Institutions (FIs), as well as research gaps and future directions. A bibliometric analysis is conducted using the Elsevier Scopus database and 658 relevant documents were identified through advance searches. The current study used performance analysis and scientific mapping method to achieve the objectives. The results show that the international collaboration exists in the discipline. It includes the evidenced from the prominent journals and the names of authors with extensive co-authorship among countries, such as China, the UK, the USA, Spain, India, Italy, Germany, and France. The keyword co-occurrences shed light on the most emerging topics in this domain, such as mutual funds, sustainable development, and the factors that integrate Environment, Society, and Governance (ESG) for financial decision-making process. Additionally, the study focused to emphasize SRI in FIs between 2011 and 2023. Therefore, the emerging significant themes point towards interdisciplinary and worldwide collaboration. This study came up with its findings in the light of new perspectives not only through an in-depth analysis of SRI within FIs but also by capturing the emergence of interdisciplinary and collaborative efforts worldwide.

Downloads

References

Abdelwahab, S. I., Taha, M. M. E., Moni, S. S., & Alsayegh, A. A. (2023). Bibliometric mapping of solid lipid nanoparticles research (2012–2022) using VOSviewer. Medicine in Novel Technology and Devices, 17, Article e100217. https://doi.org/https://doi.org/10.1016/j.medntd.2023.100217

Arco Castro, M. L., Macías Guillén, A., López Pérez, M. V., & Rodríguez Ariza, L. (2023). The role of socially responsible investors in environmental performance: An analysis of proactive and reactive practices. Journal of Cleaner Production, 419, Article e138279. https://doi.org/https://doi.org/10.1016/j.jclepro.2023.138279

Arjaliès, D.-L., Chollet, P., Crifo, P., & Mottis, N. (2023). The motivations and practices of impact assessment in socially responsible investing: The French case and its implications for the accounting and impact investing communities. Social and Environmental Accountability Journal, 43(1), 1–29. https://doi.org/10.1080/0969160X.2022.2032239

Barko, T., Cremers, M., & Renneboog, L. (2022). Shareholder engagement on environmental, social, and governance performance. Journal of Business Ethics, 180(2), 777–812. https://doi.org/10.1007/s10551-021-04850-z

Chiapello, E. (2023). Impact finance: How social and environmental questions are addressed in times of financialized capitalism. Review of Evolutionary Political Economy, 2023(2), 199–220. https://doi.org/10.1007/s43253-023-00104-y

Cobo, M. J., López-Herrera, A. G., Herrera-Viedma, E., & Herrera, F. (2011). Science mapping software tools: Review, analysis, and cooperative study among tools. Journal of the American Society for Information Science and Technology, 62(7), 1382–1402. https://doi.org/https://doi.org/10.1002/asi.21525

Crifo, P., & Forget, V. D. (2013). Think global, invest responsible: Why the private equity industry goes green. Journal of Business Ethics, 116(1), 21–48. https://doi.org/10.1007/s10551-012-1443-y

Dawkins, C. E. (2018). Elevating the role of divestment in socially responsible investing. Journal of Business Ethics, 153(2), 465–478. https://doi.org/10.1007/s10551-016-3356-7

Fu, Y. C., Marques, M., Tseng, Y.-H., Powell, J. J. W., & Baker, D. P. (2022). An evolving international research collaboration network: Spatial and thematic developments in co-authored higher education research, 1998–2018. Scientometrics, 127(3), 1403–1429. https://doi.org/10.1007/s11192-021-04200-w

Gao, J., Nyhan, J., Duke-Williams, O., & Mahony, S. (2022). Gender influences in digital humanities co-authorship networks. Journal of Documentation, 78(7), 327–350. https://doi.org/10.1108/JD-11-2021-0221

Guleria, D., & Kaur, G. (2021). Bibliometric analysis of ecopreneurship using VOSviewer and RStudio Bibliometrix, 1989–2019. Library Hi Tech, 39(4), 1001–1024. https://doi.org/10.1108/LHT-09-2020-0218

Huang, Y., Zhu, D., Lv, Q., Porter, A. L., Robinson, D. K. R., & Wang, X. (2017). Early insights on the Emerging Sources Citation Index (ESCI): An overlay map-based bibliometric study. Scientometrics, 111(3), 2041–2057. https://doi.org/10.1007/s11192-017-2349-3

Louche, C., & Hebb, T. (2014). SRI in the 21st century: Does it make a difference to society? In Socially Responsible Investment in the 21st Century: Does it Make a Difference for Society? Emerald Group Publishing Limited. https://doi.org/10.1108/S2043-905920140000007011

Markscheffel, B., & Schröter, F. (2021). Comparison of two science mapping tools based on software technical evaluation and bibliometric case studies. COLLNET Journal of Scientometrics and Information Management, 15(2), 365–396. https://doi.org/10.1080/09737766.2021.1960220

Moral-Muñoz, J. A., Herrera-Viedma, E., Santisteban-Espejo, A., & Cobo, M. J. (2020). Software tools for conducting bibliometric analysis in science: An up-to-date review. Profesional de la información, 29(1), Article e290103. https://doi.org/10.3145/epi.2020.ene.03

Moskowitz, M. (1972). Choosing socially responsible stocks. Business Society Review, 1(1), 71–75.

Nobanee, H., Al Hamadi, F. Y., Abdulaziz, F. A., Abukarsh, L. S., Alqahtani, A. F., AlSubaey, S. K., . . . Almansoori, H. A. (2021). A bibliometric analysis of sustainability and risk management. Sustainability, 13(6), Article e3277. https://doi.org/10.3390/su13063277

Oladinrin, O. T., Arif, M., Rana, M. Q., & Gyoh, L. (2023). Interrelations between construction ethics and innovation: A bibliometric analysis using VOSviewer. Construction Innovation, 23(3), 505–523. https://doi.org/10.1108/CI-07-2021-0130

Puaschunder, J. M. (2016). On the emergence, current state, and future perspectives of Socially Responsible Investment (SRI). Consilience, 16, 38–63.

Rehman, A., Ullah, I., Afridi, F.-e.-A., Ullah, Z., Zeeshan, M., Hussain, A., & Rahman, H. U. (2021). Adoption of green banking practices and environmental performance in Pakistan: A demonstration of structural equation modelling. Environment, Development and Sustainability, 23(9), 13200–13220. https://doi.org/10.1007/s10668-020-01206-x

Renneboog, L., Ter Horst, J., & Zhang, C. (2008). Socially responsible investments: Institutional aspects, performance, and investor behavior. Journal of Banking & Finance, 32(9), 1723–1742. https://doi.org/10.1016/j.jbankfin.2007.12.039

Revelli, C. (2017). Socially responsible investing (SRI): From mainstream to margin? Research in International Business and Finance, 39, 711–717. https://doi.org/10.1016/j.ribaf.2015.11.003

Richardson, B. J. (2013). Socially responsible investing for sustainability: Overcoming its incomplete and conflicting rationales. Transnational Environmental Law, 2(2), 311–338. https://doi.org/10.1017/S2047102513000150

Risi, D. (2018). Time and business sustainability: Socially responsible investing in swiss banks and insurance companies. Business & Society, 59(7), 1410–1440. https://doi.org/10.1177/0007650318777721

Scholtens, B., & Sievänen, R. (2013). Drivers of socially responsible investing: A case study of four nordic countries. Journal of Business Ethics, 115(3), 605–616. https://doi.org/10.1007/s10551-012-1410-7

Sciarelli, M., Cosimato, S., Landi, G., & Iandolo, F. (2021). Socially responsible investment strategies for the transition towards sustainable development: The importance of integrating and communicating ESG. The TQM Journal, 33(7), 39–56. https://doi.org/10.1108/TQM-08-2020-0180

Shahmoradi, L., Ramezani, A., Atlasi, R., Namazi, N., & Larijani, B. (2021). Visualization of knowledge flow in interpersonal scientific collaboration network endocrinology and metabolism research institute. Journal of Diabetes & Metabolic Disorders, 20(1), 815–823. https://doi.org/10.1007/s40200-020-00644-8

Small, H. (1999). Visualizing science by citation mapping. Journal of the American Society for Information Science, 50(9), 799–813. https://doi.org/10.1002/(SICI)1097-4571(1999)50:9<799::AID-ASI9>3.0.CO;2-G

Tanwar, A. S., Chaudhry, H., & Srivastava, M. K. (2022). Trends in influencer marketing: A review and bibliometric analysis. Journal of Interactive Advertising, 22(1), 1–27. https://doi.org/10.1080/15252019.2021.2007822

Tunger, D., & Eulerich, M. (2018). Bibliometric analysis of corporate governance research in German-speaking countries: Applying bibliometrics to business research using a custom-made database. Scientometrics, 117(3), 2041–2059. https://doi.org/10.1007/s11192-018-2919-z

Ullah, S., Jamali, D., & Harwood, I. A. (2014). Socially responsible investment: Insights from Shari'a departments in Islamic financial institutions. Business Ethics: A European Review, 23(2), 218–233. https://doi.org/10.1111/beer.12045

Wagemans, F. A. J., Koppen, C. S. A. v., & Mol, A. P. J. (2013). The effectiveness of socially responsible investment: A review. Journal of Integrative Environmental Sciences, 10(3–4), 235–252. https://doi.org/10.1080/1943815X.2013.844169

Copyright (c) 2024 Zahid Bashir, Sabeeh Iqbal, Muhammad Aamir

This work is licensed under a Creative Commons Attribution 4.0 International License.

Authors retain copyright and grant the journal right of first publication with the work simultaneously licensed under a Creative Commons Attribution (CC-BY) 4.0 License that allows others to share the work with an acknowledgement of the work’s authorship and initial publication in this journal.