Decoding Finance Lease Trends: How Firm Life Cycle Stages Influence Leasing Decisions Globally

Abstract

Abstract Views: 0

Abstract Views: 0

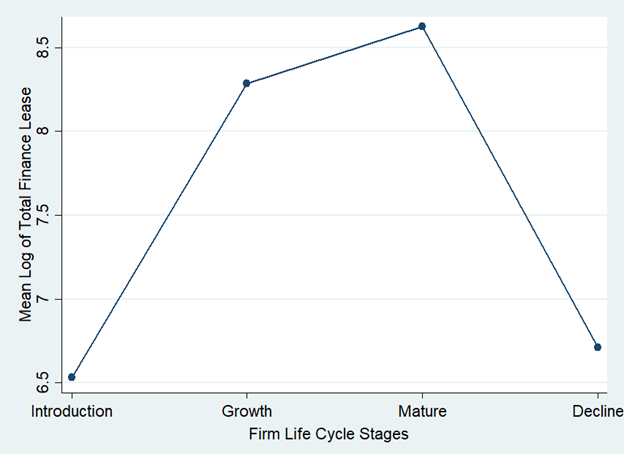

The current study aims to analyze the influence of Firm Life Cycle Stages (FLCS) on the finance lease decisions of non-financial and non-utility firms around the globe. Data is gathered from S&P Capital IQ Pro for the period of 2000–2023. The final sample consists of 72,031 firm-year observations, covering a broad range of non-financial and non-utility firms around the globe. To estimate the relationship between FLCS and finance leases, the current study employed Fixed Effects regression as the main method and Ordinary Least Squares (OLS) regression as a complementary method. Moreover, to confirm the consistency of findings across different model specifications, the robustness of results was tested by splitting the total finance lease into current and long-term portions. The regression results of both methods indicate that finance lease usage changes with FLCS in an inverted U-shaped pattern. This demonstrates the lower use of finance lease by firms in the introduction and decline stages and a higher use of finance lease in the growth and maturity stages. These findings are substantiated by robustness tests. Thus, the overall results prove that a finance lease is a flexible financial tool and firms adapt it according to the specific requirements of life cycle stages. The findings have implications for both investors and financial managers. This may help investors in evaluating their investment decisions when considering the consequences of finance lease adjustments. Moreover, it would also aid them in accomplishing the goal of shareholder wealth maximization through proactive and effective decision-making. In the future, this phenomenon may be examined separately for segments based on economic development or regions.

Downloads

References

Abuhommous, A. A. A. (2023). Corporate life cycle and credit scoring. Journal of Applied Economics, 26(1), Article e2255444. https://doi.org/10.1080/15140326.2023.2255444

Adu-Ameyaw, E., Danso, A., & Hickson, L. (2022). Growth opportunity and investment policy: The role of managerial incentives. Managerial and Decision Economics, 43(8), 3634–3646. https://doi.org/10.1002/mde.3619

Ames, D., Coyne, J., & Kim, K. (2020). The impact of life cycle stage on firm acquisitions. International Journal of Accounting & Information Management, 28(2), 223–241. https://doi.org/10.1108/IJAIM-02-2019-0027

Ang, J., & Peterson, P. P. (1984). The leasing puzzle. The Journal of Finance, 39(4), 1055–1065. https://doi.org/10.1111/j.1540-6261.1984.tb03892.x

Bhatia, A., & Kumari, P. (2024). The moderating effect of corporate governance factors on capital structure and performance: Evidence from Indian companies. Corporate Governance: The International Journal of Business in Society, 24(5), 1083–1102. https://doi.org/10.1108/CG-06-2023-0239

Budiarso, N. S., Subroto, B., Sutrisno, T., & Pontoh, W. (2019). Dividend catering, life-cycle, and policy: Evidence from Indonesia. Cogent Economics & Finance, 7(1), 1–15. https://doi.org/10.1080/23322039.2019.1594505

Cadenovic, J., Deloof, M., & Paeleman, I. (2024). Do dividend policies of privately held firms follow a life cycle? The European Journal of Finance, 30(5), 457–480. https://doi.org/10.1080/1351847X.2023.2206523

Cai, K., Lee, H., & Zhu, H. (2024). Impacts of firm life cycle on bond ratings and yields. Journal of Financial Research, 47(4), 1083–1117. https://doi.org/10.1111/jfir.12390

Callimaci, A., Fortin, A., & Landry, S. (2011). Determinants of leasing propensity in Canadian listed companies. International Journal of Managerial Finance, 7(3), 259–283. https://doi.org/10.1108/17439131111144469

Castro, P., Tascón, M. T., & Amor-Tapia, B. (2015). Dynamic analysis of the capital structure in technological firms based on their life cycle stages. Spanish Journal of Finance and Accounting, 44(4), 458–486. https://doi.org/10.1080/02102412.2015.1088202

Cosci, S., Guida, R., & Meliciani, V. (2015). Leasing decisions and credit constraints: Empirical analysis on a sample of Italian firms. European Financial Management, 21(2), 377–398. https://doi.org/10.1111/j.1468-036X.2013.12019.x

Dickinson, V. (2011). Cash flow patterns as a proxy for firm life cycle. The Accounting Review, 86(6), 1969–1994. https://doi.org/10.2308/accr-10130

Duke, J. C., Hsieh, S. J., & Su, Y. (2009). Operating and synthetic leases: Exploiting financial benefits in the post-Enron era. Advances in Accounting, 25(1), 28–39. https://doi.org/10.1016/j.adiac.2009.03.001

Fodor, A., Lovelace, K. B., Singal, V., & Tayal, J. (2024). Does firm life cycle stage affect investor perceptions? Evidence from earnings announcement reactions. Review of Accounting Studies, 29(2), 1039–1096. https://doi.org/10.1007/s11142-022-09749-2

Gerhardt, V., Siluk, J., Manosso, T. W. S., Stieler, E. G., Rodrigues, E. L., & Michelin, C. (2024). Management of intangible aspects considering agricultural business development. Ciência Rural, 54(6), Article e20230267. https://doi.org/10.1590/0103-8478cr20230267

Giner, B., & Pardo, F. (2018). The value relevance of operating lease liabilities: Economic effects of IFRS 16. Australian Accounting Review, 28(4), 496–511. https://doi.org/10.1111/auar.12233

Habib, A., & Hasan, M. M. (2017). Firm life cycle, corporate risk‐taking and investor sentiment. Accounting & Finance, 57(2), 465–497. https://doi.org/10.1111/acfi.12141

Hamilton, D. (2023). State of the global leasing industry: Continued innovation and strength. World Leasing Yearbook. https://www.world-leasing-yearbook.com/wp-content/uploads/2023/12/GLR24-1st-2-pages-1.pdf

Hasan, M. M., Al-Hadi, A., Taylor, G., & Richardson, G. (2017). Does a firm’s life cycle explain its propensity to engage in corporate tax avoidance? European Accounting Review, 26(3), 469–501. https://doi.org/10.1080/09638180.2016.1194220

Hasan, M. M., Cheung, A., Tunas, L., & Kot, H. W. (2021). Firm life cycle and trade credit. Financial Review, 56(4), 743–771. https://doi.org/10.1111/fire.12264

Hu, W., Li, K., & Xu, Y. (2024). Lease-adjusted productivity measurement. Journal of Banking & Finance, 164, Article e107121. https://doi.org/10.1016/j.jbankfin.2024.107121

Huse, M., & Zattoni, A. (2008). Trust, firm life cycle, and actual board behavior: Evidence from" one of the lads" in the board of three small firms. International Studies of Management & Organization, 38(3), 71–97. https://doi.org/10.2753/IMO0020-8825380303

Industry Growth Insights. (2021). Finance lease market: Global industry analysis, trends, market size, and forecasts (2021–2030). Industry Growth Insights. https://industrygrowthinsights.com/report/finance-lease-market/

International Accounting Standards Board (IASB) (2016), International Financial Reporting Standard No. 16, Leases, IASB, London.

Jaggi, B., Allini, A., Casciello, R., & Meucci, F. (2022). Firm life cycle stages and earnings management. Review of Quantitative Finance and Accounting, 59(3), 1019–1049. https://doi.org/10.1007/s11156-022-01069-5

Khuong, N. V., Anh, L. H. T., & Van, N. T. H. (2022). Firm life cycle and earnings management: The moderating role of state ownership. Cogent Economics & Finance, 10(1), Article e2085260. https://doi.org/10.1080/23322039.2022.2085260

Krishnan, G. V., Myllymäki, E. R., & Nagar, N. (2021). Does financial reporting quality vary across firm life cycle? Journal of Business Finance & Accounting, 48(5–6), 954–987. https://doi.org/10.1111/jbfa.12508

Krishnan, V. S., & Moyer, R. C. (1994). Bankruptcy costs and the financial leasing decision. Financial Management, 23(2), 31–42. https://doi.org/10.2307/3665737

Lau, C. K. (2022). The economic consequences of IFRS 16 adoption: The role of gearing restriction in debt covenants. Journal of Applied Accounting Research, 24(3), 464–482. https://doi.org/10.1108/JAAR-08-2021-0208

Li, T., Karim, R., & Munir, Q. (2016). The determinants of leasing decisions: An empirical analysis from Chinese listed SMEs. Managerial Finance, 42(8), 763–780. https://doi.org/10.1108/MF-06-2015-0166

Medeiros, M. N., & Machado, M. (2024). Life cycle stages and corporate decisions. RAM. Revista de Administração Mackenzie, 25(1), Article eRAMF240259. https://doi.org/10.1590/1678-6971/eRAMF240259.en

Miller, D., & Friesen, P. H. (1984). A longitudinal study of the corporate life cycle. Management Science, 30(10), 1161–1183. https://doi.org/10.1287/mnsc.30.10.1161

Morshed, A. (2024). Comparative analysis of accounting standards in the Islamic banking industry: A focus on financial leasing. Journal of Islamic Accounting and Business Research, ahead of print. https://doi.org/10.1108/JIABR-12-2022-0349

Mou, X., & Li, S. (2024). Real estate regulation and default risk on financial lease contracts. Emerging Markets Finance and Trade, 60(3), 617–630. https://doi.org/10.1080/1540496X.2023.2228464

Mueller, D.C. (1972). A life cycle theory of the firm. The Journal of Industral Economics, 20(3), 199–219. https://doi.org/10.2307/2098055

Park, Y., & Na, K. (2018). The effect of lease accounting on credit rating and cost of debt: Evidence from firms in Korea. Social Sciences, 7(9), Article e154. https://doi.org/10.3390/socsci7090154

Realdon, M. (2006). Pricing the credit risk of secured debt and financial leasing. Journal of Business Finance & Accounting, 33(7–8), 1298–1320. https://doi.org/10.1111/j.1468-5957.2006.00619.x

Rehman, A. U., Ahmad, T., Hussain, S., & Hassan, S. (2021). Corporate cash holdings and firm life cycle: Evidence from China. Journal of Asia Business Studies, 15(4), 625–642. https://doi.org/10.1108/JABS-07-2020-0272

Robicheaux, S. H., Fu, X., & Ligon, J. A. (2008). Lease financing and corporate governance. Financial Review, 43(3), 403–437. https://doi.org/10.1111/j.1540-6288.2008.00200.x

Sa’diyyah, D. K., Herwanda, R., & Firmansyah, A. (2024). The impact of IFRS 16 implementation on tax aggressiveness: Do right-of-use assets and lease liabilities matter? Educoretax, 4(4), 526–532. https://doi.org/10.54957/educoretax.v4i4.777

Sangwan, V., Kushwaha, S., Prakash, P., & Singh, A. (2023). Life cycle stage as determinant of operational efficiency with implications for benchmarking. Applied Economics, 56(54), 1–18. https://doi.org/10.1080/00036846.2023.2277688

Sangwan, P., Gupta, M., & Kumar, S. (2024). Research on the impact of technological finance on high-quality economic growth. Applied Economics Letters, 31(1), 71–74. https://doi.org/10.1080/13504851.2022.2126816

Thu, L. B., & Khuong, N. V. (2023). How does the corporate life cycle influence Vietnamese firm’s corporate social responsibility? Cogent Economics & Finance, 11(1), Article e2186043. https://doi.org/10.1080/23322039.2023.2186043

Wang, W., Feng, L., Li, Y., Xu, F., & Deng, Q. (2020). Role of financial leasing in a capital-constrained service supply chain. Transportation Research Part E: Logistics and Transportation Review, 143, Article e102097. https://doi.org/10.1016/j.tre.2020.102097

Wang, G. J. (2024). Impact of lease versus buy decisions on government tax revenues: An in‐depth analysis. Journal of Corporate Accounting & Finance, 35, 230–240. https://doi.org/10.1002/jcaf.22706

Wicaksana, W., & Putra, Y. M. (2024). The influence of financial derivatives, financial leases and institutional ownership on tax avoidance. Economics & Islamic Finance Journal (ECIF), 1(1), 1–13.

Yazdanfar, D., & Öhman, P. (2014). Life cycle and performance among SMEs: Swedish empirical evidence. The Journal of Risk Finance, 15(5), 555–571. https://doi.org/10.1108/JRF-04-2014-0043

Zhang, H., Ye, H., Dong, L., & Wang, J. (2024). CSR performance of dual-class firms in different life cycle stages. Applied Economics, 1–14. https://doi.org/10.1080/00036846.2024.2331426

Zhang, X., Xue, H., Zhang, Y., & Ding, S. (2020). Growth opportunities or cash flow drives innovative investment: Evidence with different ownership structure from China. Emerging Markets Finance and Trade, 56(11), 2491–2508. https://doi.org/10.1080/1540496X.2019.1668268

Zhang, Y., Yao, D., & Zhang, C. (2020). Bank loan versus financial lease: How do traditional and innovative approaches within the banking sector influence economic growth? A comparative analysis between the US and China. Applied Economics, 52(40), 4366–4383. https://doi.org/10.1080/00036846.2020.1735617

Copyright (c) 2024 Ahmad Ghazali, Mubashar Tanveer

This work is licensed under a Creative Commons Attribution 4.0 International License.

Authors retain copyright and grant the journal right of first publication with the work simultaneously licensed under a Creative Commons Attribution (CC-BY) 4.0 License that allows others to share the work with an acknowledgement of the work’s authorship and initial publication in this journal.