A Low-Risk vs. Market-Based Portfolio in Equity Market: Evidence from Global Financial Crisis and Global Pandemic Crisis in Pakistan

Abstract

Abstract Views: 0

Abstract Views: 0

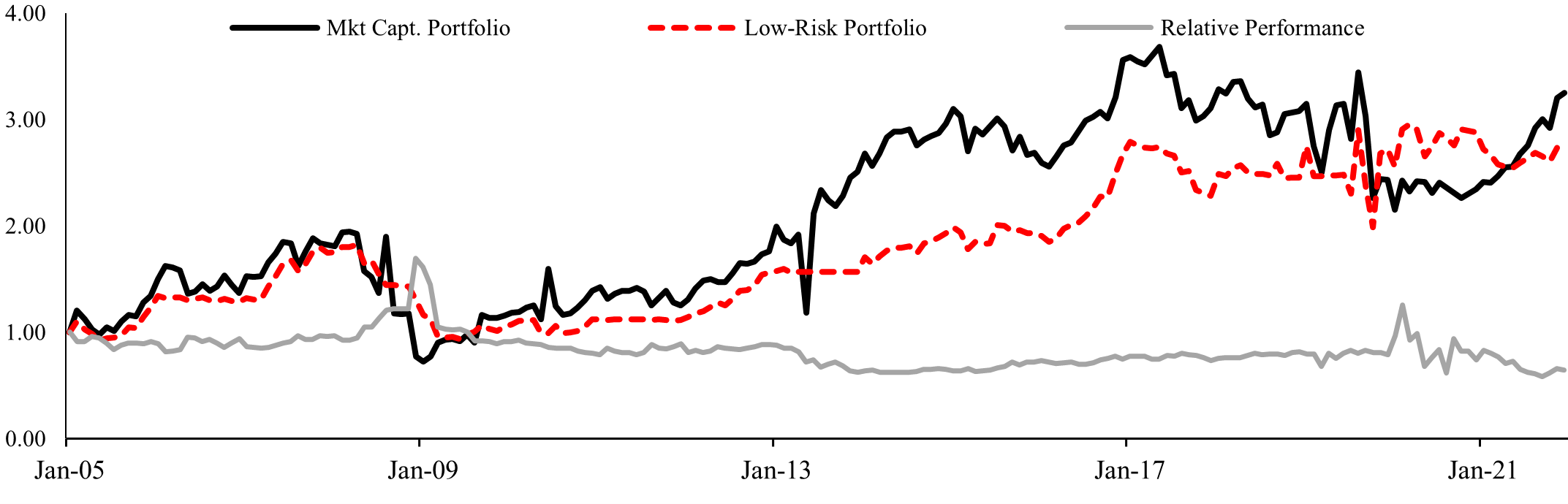

The study tests the characteristics of a low-risk-based portfolio compared with a broader market-capitalization weighted portfolio (benchmark portfolio) in Pakistan Stock Exchange (PSX). This study considers all listed stocks at PSX as an investment universe. Low-risk stocks were assessed by measuring the idiosyncratic risk. Extensive back-tests were performed to compare the financial performance for 2005-2022. Results show that the market-capitalization-based portfolio outperforms the low-risk-based portfolio in terms of annualized returns. However, the latter significantly reduces the risk and leads to superior risk-adjusted performance. The low-risk portfolio indicates resilience to market turmoil and reduces the downside risk of the market portfolio. The risk-return relationship appears to be stronger in the case of idiosyncrasies. The effect of the GFC-2008 and the GPC-2020 are also investigated; the results indicate that a low-risk-based portfolio carries higher returns while the market capitalization portfolio carries relatively higher risk. Both individuals and institutional investors can enhance the risk-adjusted performance of their portfolios by adopting a low-risk-based strategy.

Downloads

References

Adhami, S., Gianfrate, G., & Johan, S. (2023). Risks and returns in crowdlending. Eurasian Business Review, 13(2), 309–340. https://doi.org/10.1007/s40821-022-00236-x

Alighanbari, M., Doole, S., & Shankar, D. (2016). Designing Low-Volatility Strategies. The Journal of Index Investing, 7(3), 21–33. https://doi.org/10.3905/jii.2016.7.3.021

Almansour, B. Y., Elkrghli, S., & Almansour, A. Y. (2023). Behavioral finance factors and investment decisions: A mediating role of risk perception. Cogent Economics & Finance, 11(2), Article e2239032. https://doi.org/10.1080/23322039.2023.2239032

Ang, A., Hodrick, R. J., Xing, Y., & Zhang, X. (2009). High idiosyncratic volatility and low returns: International and further US evidence. Journal of Financial Economics, 91(1), 1–23. https://doi.org/10.1016/j.jfineco.2007.12.005

Asness, C. S., Frazzini, A., & Pedersen, L. H. (2014). Low-risk investing without industry bets. Financial Analysts Journal, 7(4), 24–41. https://doi.org/10.2469/faj.v70.n4.1

Baker, M., Bradley, B., & Wurgler, J. (2011). Benchmarks as limits to arbitrage: Understanding the low-volatility anomaly. Financial Analysts Journal, 67(1), 40–54. https://doi.org/10.2469/faj.v67.n1.4

Baker, N. L., & Haugen, R. A. (2012). Low risk stocks outperform within all observable markets of the world. Available at SSRN 2055431. http://dx.doi.org/10.2139/ssrn.2055431

Banz, R. W. (1981). The relationship between return and market value of common stocks. Journal of Financial Economics, 9(1), 3–18. https://doi.org/10.1016/0304-405X(81)90018-0

Bekaert, G., Harvey, C. R., & Lundblad, C. (2006). Growth volatility and financial liberalization. Journal of International Money and Finance, 25, 370–403. https://doi.org/10.1016/j.jimonfin.2006.01.003

Bishwal, J. P. (2022). Stochastic Volatility Models: Methods of Pricing, Hedging and Estimation. In Parameter Estimation in Stochastic Volatility Models (pp. 1–77). Cham: Springer International Publishing.

Black, F., Jensen, M. C., & Scholes, M. (1972). The Capital Asset Pricing Model: Some Empirical Tests. In M. C. Jensen (Ed.), Studies in the Theory of Capital Markets. Praeger.

Blitz, D. C., & Van Vliet, P. (2007). The volatility effect. The Journal of Portfolio Management, 34(1), 102–113. https://doi.org/10.3905/jpm.2007.698039

Blitz, D., & De Groot, W., (2014). Strategic allocation to commodity factor premiums. Journal of Alternative Investments, 17, 103–115. http://dx.doi.org/10.2139/ssrn.2265901

Blitz, D., Pang, J., & Van Vliet, P. (2013). The volatility effect in emerging markets. Emerging Markets Review, 16, 31–45. https://doi.org/10.1016/j.ememar.2013.02.004

Bordo, M. D., & Landon-Lane, J. S. (2010). The global financial crisis of 2007-08: Is it unprecedented? (No. w16589). National Bureau of Economic Research.

Boudt, K., Raza, M. W., & Ashraf, D. (2019). Macro-financial regimes and performance of Shariah-compliant equity portfolios. Journal of International Financial Markets, Institutions and Money, 60, 252–266. https://doi.org/10.1016/j.intfin.2019.01.001

Bradrania, R., Veron, J. F., & Wu, W. (2023). The beta anomaly and the quality effect in international stock markets. Journal of Behavioral and Experimental Finance, 38, Article e100808. https://doi.org/10.1016/j.jbef.2023.100808

Cao, J., & Han, B. (2013). Cross section of option returns and idiosyncratic stock volatility. Journal of Financial Economics, 108(1), 231–249. https://doi.org/10.1016/j.jfineco.2012.11.010

Carhart, M. M. (1997). On persistence in mutual fund performance. The Journal of Finance, 52(1), 57–82. https://doi.org/10.1111/j.1540-6261.1997.tb03808.x

Chen, J. (2017). What explains the investment anomaly in the Chinese stock market? Nankai Business Review International, 8(4), 495–520. https://doi.org/10.1108/NBRI-05-2016-0021

Chen, X. B., Silvapulle, P., & Silvapulle, M. (2014). A semiparametric approach to value-at-risk, expected shortfall and optimum asset allocation in stock–bond portfolios. Economic Modelling, 42, 230–242. https://doi.org/10.1016/j.econmod.2014.07.010

Chow, T. M., Hsu, J. C., Kuo, L. L., & Li, F. (2014). A study of low-volatility portfolio construction methods. The Journal of Portfolio Management, 40(4), 89–105. https://doi.org/10.3905/jpm.2014.40.4.089

Dimson, E., Marsh, P., & Staunton, M. (2017). Factor-based investing: The long-term evidence. Journal of Portfolio Management, 43(5), 15–37. https://doi.org/10.3905/jpm.2017.43.5.015

Fama, E. F. (1965a). The behavior of stock-market prices. The Journal of Business, 38(1), 34–105. https://doi.org/10.1086/294743

Fama, E. F. (1965b). Random walks in stock-market prices. Financial Analysis Journal, 51(1), 75–80. https://doi.org/10.2469/faj.v51.n1.1861

Fama, E. F., & French, K. R. (1992). The cross‐section of expected stock returns. The Journal of Finance, 47(2), 424–465. https://doi.org/10.1111/j.1540-6261.1992.tb04398.x

Fama, E. F., & French, K. R. (1993). The common risk factors in the returns of stocks and bonds. The Journal of Financial Economics, 33(1), 3–56. https://doi.org/10.1016/0304-405X(93)90023-5

Fama, E.F., French, K.R., (1998). Value versus growth: The international evidence. Journal of Finance, 53, 1975–1999. https://doi.org/10.1111/0022-1082.00080

Fama, E. F. (1970). Efficient capital markets. Journal of Finance, 25(2), 383–417. https://doi.org/10.7208/9780226426983-007

Frazzini, A., & Pedersen, L. H. (2014). Betting against beta. Journal of Financial Economics, 111(1), 1–25. https://doi.org/10.1016/j.jfineco.2013.10.005

Ghufran, B., Awan, H. M., Khakwani, A. K., & Qureshi, M. A. (2016). What causes stock market volatility in Pakistan? Evidence from the field. Economics Research International, 2016. Article e3698297 https://doi.org/10.1155/2016/3698297

Gupta, S., (2018). Risk anomaly exploration in Indian stock market. International Journal of Scientific & Engineering Research, 9(7), 1207–1210.

Han, X., Li, K., Li, Y. (2020). Investor overconfidence and the security market line: New evidence from China. Journal of Economic Dynamics and Control, 117, Article e103961. https://doi.org/10.1016/j.jedc.2020.103961

Haugen, R. A., & Baker, N. L. (1991). The efficient market inefficiency of capitalization-weighted stock portfolios. Journal of Portfolio Management, 17(3), 35–40.

Haugen, R. A., & Baker, N. L. (2008). The handbook of portfolio construction: Contemporary applications of Markowitz techniques. Forthcoming.

Haugen, R. A., & Heins, A. J. (1975). Risk and the rate of return on financial assets: Some old wine in new bottles. Journal of Financial and Quantitative Analysis, 109(5), 775–784. https://doi.org/10.2307/2330270

Hou, K., Xue, C., & Zhang, L. (2020) Replicating anomalies. The Review of Financial Studies, 33(5), 2019–2133. https://doi.org/10.1093/rfs/hhy131

Hussain, F., & Uppal, J., (1999). Stocks return volatility in an emerging market: The Pakistani evidence. Pakistan Journal of Applied Economics, 15(1) and (2), 19–40.

Hussain, N., & Khan, M. T. (2023). Firm’s growth and share price volatility: Evidence from Pakistan. UW Journal of Management Sciences, 7(1), 128–139.

Jensen, T.I., Kelly, B.T., & Pedersen, L.H. (2022). Is there a replication crisis in finance? NBER Working Paper Series, Article ew28432. https://doi.org/10.1111/jofi.13249

Joshipura, N., & Joshipura, M. (2019). The volatility effect: Recent evidence from Indian markets. Theoretical Economics Letters, 9(6), 2152–2164. https://doi.org/10.4236/tel.2019.96136

Kothe, J., Lohre, H., Rother, C. (2021). Rates factors and global asset allocation. Journal of Fixed Income, 30(3), 6–25. https://doi.org/10.3905/jfi.2020.1.098

Lee, K. H. (2011). The world price of liquidity risk. Journal of Financial Economics, 99(1), 136–161. https://doi.org/10.1016/j.jfineco.2010.08.003

LeRoy, S. F., & Porter, R. D. (1981). The present-value relation: Tests based on implied variance bounds. Econometrica: Journal of the Econometric Society, 555–574. https://doi.org/10.2307/1911512

Li, X., Sullivan, R. N., & Garcia-Feijóo, L. (2014). The limits to arbitrage and the low-volatility anomaly. Financial Analysts Journal, 70(1), 52–63. https://doi.org/10.2469/faj.v70.n1.3

Lintner, J. (1965). The valuation of risk assets and the selection of risky investments in stock portfolios and capital budgets. Review of Economics and Statistics, 47(1), 13–37. https://doi.org/10.2307/1924119

Malkiel, B. G. (2003). The efficient market hypothesis and its critics. Journal of Economic Perspectives, 17(1), 59–82. https://doi.org/10.1257/089533003321164958

Markowitz, H. (1952). Portfolio SELECTION. The Journal of Finance, 7(1), 77–91. https://doi.org/10.1111/j.1540-6261.1952.tb01525.x

Markowitz, H. (1965). Portfolio selection: Efficient diversification of investments. John Wiley & Sons.

Mossin J, (1966). Equilibrium in a capital asset market. Econometrica, 35(4), 768–783. https://doi.org/10.2307/1910098

Mubarak, M. F., Shaikh, F. A., Mubarik, M., Samo, K. A., & Mastoi, S. (2019). The impact of digital transformation on business performance: A study of Pakistani SMEs. Engineering Technology & Applied Science Research, 9(6), 5056–5061.

Patel, S. A., & Sarkar, A. (1998). Crises in developed and emerging stock markets. Financial Analysts Journal, 54(6), 50–61. https://doi.org/10.2469/faj.v54.n6.2225

Pyun, C. (2021). Documenting the post-2000 decline in the idiosyncratic volatility effect. Critical Finance Review, 10(3), 419–427. https://doi.org/10.1561/104.00000095

Raza, M. W., & Ashraf, D. (2019). Does the application of smart beta strategies enhance portfolio performance? The case of Islamic equity investments. International Review of Economics & Finance, 60, 46–61. https://doi.org/10.1016/j.iref.2018.12.001

Raza, M. W., Said, B., & Elshahat, A. (2023). Covid-19 and informational efficiency in Asian emerging markets: A comparative study of conventional and Shariah-compliant stocks. International Journal of Islamic and Middle Eastern Finance and Management, 16(3), 576–592. https://doi.org/10.1108/IMEFM-01-2022-0041

Rouwenhorst, K. Geert, 1999, Local return factors and turnover in emerging stock markets, Journal of Finance, 54, 1439–1464. https://doi.org/10.1111/0022-1082.00151

Saengchote, K. (2017). The low-risk anomaly: Evidence from Thai Stock market. Asian Academy of Management Journal of Accounting & Finance, 13(1), 143–158. https://doi.org/10.21315/aamjaf2017.13.1.6

Said, B., Raza, M. W., & Elshahat, A. (2024). Does market microstructure affect time-varying efficiency? Evidence from emerging markets. Research in International Business and Finance, Article e102347. https://doi.org/10.1016/j.ribaf.2024.102347

Said, B., Rehman, S. U., Ullah, R., & Khan, J. (2021). Investor overreaction and global financial crisis: A case of Pakistan stock exchange. Cogent Economics & Finance, 9(1), Article e1966195. https://doi.org/10.1080/23322039.2021.1966195

Sharpe, W. F. (1964). Capital asset prices: A theory of market equilibrium under conditions of risk. The Journal of Finance, 19(3), 425–442. https://doi.org/10.1111/j.1540-6261.1964.tb02865.x

Thaler, R. H. (1999). The end of behavioral finance. Financial Analysts Journal, 55(6), 12–17.

Traut, J. (2023). What we know about the low-risk anomaly: A literature review. Financial Markets and Portfolio Management, 37(3), 297–324. https://doi.org/10.1007/s11408-023-00427-0

Hart, V., Slagter. E., & Dijk, D. (2003). Stock selection strategies in emerging markets. Journal of Empirical Finance, 10(1–2), 105–132. https://doi.org/10.1016/S0927-5398(02)00022-1

Yalçın, K. C. (2010). Market rationality: Efficient market hypothesis versus market anomalies. European Journal of Economic and Political Studies, 3(2), 23–38.

Yang, B., & Ma, Y. (2021). Value at risk, mispricing and expected returns. International Review of Financial Analysis, 78, Article e101902. https://doi.org/10.1016/j.irfa.2021.101902

Zia-ur-Rehman, M. (2023). Critical issues of governance in Pakistan: Strategies and Solutions. ISSRA Papers, 15(1), 77–86.

Copyright (c) 2024 Muhammad Wajid Raza, Bahrawar Said, Ijaz Hassan

This work is licensed under a Creative Commons Attribution 4.0 International License.

Authors retain copyright and grant the journal right of first publication with the work simultaneously licensed under a Creative Commons Attribution (CC-BY) 4.0 License that allows others to share the work with an acknowledgement of the work’s authorship and initial publication in this journal.