Mitigating Tax Avoidance through Corporate Governance: The Mediating Role of Financial Distress

Abstract

Abstract Views: 0

Abstract Views: 0

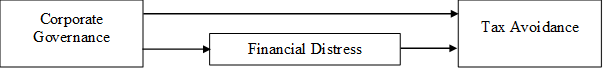

The post-pandemic era has brought Pakistan into a spiral of economic instability and downturn, making taxation a vital avenue for the economic survival of country. One of the key avenues of revenue collection for an economy is its manufacturing sector. Therefore, the current study analyzed the facilitating role of financial distress to examine the relationship amongst governance mechanisms and tax avoidance. The sample comprised data collected from 167 firms for 13 years, from the time period of 2011-2023. Panel data Generalized Method of Moment (GMM) regression model is utilized for analysis. Findings indicate that the firms in Pakistan tend to get involved in tax avoidance during economic distress and effective corporate governance may significantly reduce this behavior. The mediation analysis established that the association of board structure and tax avoidance is channeled through financial distress. This association highlighted those weak corporate mechanisms in a firm leading to financial distress which, in turn, leads to tax avoidance behavior. Hence, addressing corporate governance issues in the firm may also indirectly influence the tax avoidance behavior in the corporate sector of Pakistan. Furthermore, the control variables including firm size (FS), market-to-book ratio, return on assets (ROA), and leverage (LEV) have non-significant influence on tax avoidance. The study provided some unique implications related to tax avoidance, particularly with context to a struggling economy, such as Pakistan. These findings may also help tax officials to be more cautious of the firms that have weak indicators of corporate governance. Furthermore, in weak economic scenarios, such as Pakistan, tax avoidance practices tend to increase across the business sectors. Lastly, this association between tax management and financial distress would enable the investors' needs to assess premium cash flow and the risk of capital costs.

Downloads

References

Altman, E. I. (2013). Predicting financial distress of companies: Revisiting the Z-score and ZETA® models. In Handbook of research methods and applications in empirical finance (pp. 428–456). Edward Elgar Publishing.

Badertscher, B. A., Katz, S. P., & Rego, S. O. (2013). The separation of ownership and control and corporate tax avoidance. Journal of Accounting and Economics, 56(2–3), 228–250. https://doi.org/10.1016/j.jacceco.2013.08.005

Balasoiu, N., Chifu, I., & Oancea, M. (2023). Impact of direct taxation on economic growth: Empirical evidence based on panel data regression analysis at the level of EU countries. Sustainability, 15(9), Article e7146. https://doi.org/10.3390/su15097146

Baron, R. M., & Kenny, D. A. (1986). The moderator–mediator variable distinction in social psychological research: Conceptual, strategic, and statistical considerations. Journal of Personality and Social Psychology, 51(6), Article e1173. https://doi.org/10.1037/0022-3514.51.6.1173

Bayar, O., Huseynov, F., & Sardarli, S. (2018). Corporate governance, tax avoidance, and financial constraints. Financial Management, 47(3), 651–677. https://doi.org/10.1111/fima.12208

Core, J. E., Holthausen, R. W., & Larcker, D. F. (1999). Corporate governance, chief executive officer compensation, and firm performance. Journal of Financial Economics, 51(3), 371–406. https://doi.org/10.1016/S0304-405X(98)00058-0

DeBoskey, D. G., Luo, Y., & Zhou, L. (2019). CEO power, board oversight, and earnings announcement tone. Review of Quantitative Finance and Accounting, 52(2), 657–680. https://doi.org/10.1007/s11156-018-0721-x

Demirag, I., Sudarsanam, S., & Wright, M. (2000). Corporate governance: Overview and research agenda. The British Accounting Review, 32(4), 341–354. https://doi.org/10.1006/bare.2000.0146

Dube, F., Nzimande. N., & Muzindutsi, P.-F. (2023). Application of artificial neural networks in predicting financial distress in the JSE financial services and manufacturing companies. Journal of Sustainable Finance and Investment, 13(1), 723–743. https://doi.org/10.1080/20430795.2021.2017257

Duhoon, A., & Singh, M. (2023). Corporate tax avoidance: A systematic literature review and future research directions. LBS Journal of Management & Research, 21(2), 197–217. https://doi.org/10.1108/LBSJMR-12-2022-0082

Dyreng, S. D., Hanlon, M., Maydew, E. L., & Thornock, J. R. (2017). Changes in corporate effective tax rates over the past 25 years. Journal of Financial Economics, 124(3), 441–463. https://doi.org/10.1016/j.jfineco.2017.04.001

Elloumi, F., & Gueyié, J.-P. (2001). Financial distress and corporate governance: An empirical analysis. Corporate Governance: The International Journal of Business in Society, 1(1), 15–23. https://doi.org/10.1108/14720700110389548

Eskandari, R., & Kordestani, G. (2024). Agency costs and the relationship between financial distress risk and the stock prices crash risk. Financial Management Strategy, 12(2), 87–112. https://doi.org/10.22051/jfm.2024.45464.2877

Feizi, M., Panahi, E., Keshavarz, F., Mirzaee, S., & Mosavi, S. M. (2016). The impact of the financial distress on tax avoidance in listed firms: Evidence from Tehran Stock Exchange (TSE). International Journal of Advanced Biotechnology and Research, 7(1), 373–382.

Frank, M. M., Lynch, L. J., & Rego, S. O. (2009). Tax reporting aggressiveness and its relation to aggressive financial reporting. The Accounting Review, 84(2), 467–496. https://doi.org/10.2308/accr.2009.84.2.467

Garman, M. B., & Ohlson, J. A. (1980). Information and the sequential valuation of assets in arbitrage-free economies. Journal of Accounting Research, 18(1), 420–440.

Gomes, A. P. M. (2016). Corporate governance characteristics as a stimulus to tax management. Revista Contabilidade & Finanças, 27(71), 149–168. https://doi.org/10.1590/1808-057x201500750

Grice, J. S., & Dugan, M. T. (2001). The limitations of bankruptcy prediction models: Some cautions for the researcher. Review of Quantitative Finance and Accounting, 17(2), 151–166. https://doi.org/10.1023/A:1017973604789

Habib, A., Costa, M. D., Huang, H. J., Bhuiyan, Md. B. U., & Sun, L. (2020). Determinants and consequences of financial distress: Review of the empirical literature. Accounting & Finance, 60(S1), 1023–1075. https://doi.org/10.1111/acfi.12400

Kaur, G., & Rani, V. (2021). Growth of corporate tax in India: An Analysis. Gyan Management Journal, 15(2), Article e2. https://doi.org/10.48165/gm.2021.1529

Khan, B., Rasheed, M. H., & Uddin, S. (2022). Firms’ performance in Pakistan: The impact of government policies, capital structure, and board diversity. NUML International Journal of Business & Management, 17, 1–15. https://doi.org/10.52015/nijbm.v17i2.134

Khan, N., Ahmed, W., Maqbool, Z., Sadiq, S., & Rasheed, M. H. (2023). Does ownership concentration moderates in CSR and firm performance relationship? An evidence from non-financial sector listed companies of Pakistan. Journal of Namibian Studies: History Politics Culture, 34, 2940–2957.

Khan, N., Malik, Q. A., Saghir, A., Rasheed, M. H., & Husnain, M. (2021). Does corporate social responsibility reduce financial distress? Evidence from emerging economy. Management Science Letters, 8(11), 2225–2232. https://doi.org/10.5267/j.msl.2021.4.007

Kovermann, J., & Velte, P. (2019). The impact of corporate governance on corporate tax avoidance: A literature review. Journal of International Accounting, Auditing and Taxation, 36, Article e100270. https://doi.org/10.1016/j.intaccaudtax.2019.100270

Kumar, A., Jeswani, S., Farooq, R., & Rasheed, M. H. (2024). Evaluating the impact of financial stability and monetary stability on economic growth: Evidence from an emerging economy. Pakistan Journal of Humanities and Social Sciences, 12(1), Article e1. https://doi.org/10.52131/pjhss.2024.v12i1.1952

Lanis, R., & Richardson, G. (2011). The effect of board of director composition on corporate tax aggressiveness. Journal of Accounting and Public Policy, 30(1), 50–70. https://doi.org/10.1016/j.jaccpubpol.2010.09.003

Mathew, S., Ibrahim, S., & Archbold, S. (2018). Corporate governance and firm risk. Corporate Governance: The International Journal of Business in Society, 18(1), 52–67. https://doi.org/10.1108/CG-02-2017-0024

Minnick, K., & Noga, T. (2010). Do corporate governance characteristics influence tax management? Journal of Corporate Finance, 16(5), 703–718. https://doi.org/10.1016/j.jcorpfin.2010.08.005

Preacher, K. J., & Hayes, A. F. (2004). SPSS and SAS procedures for estimating indirect effects in simple mediation models. Behavior Research Methods, Instruments, & Computers, 36(4), 717–731. https://doi.org/10.3758/BF03206553

Rasheed, M. H., Khalid, J., Ali, A., Rasheed, M. S., & Ali, K. (2024). Human resource analytics in the era of artificial intelligence: Leveraging knowledge towards organizational success in Pakistan. Journal of Chinese Human Resources Management, 15(3), 3–20. https://doi.org/10.47297/wspchrmWSP2040-800501.20241503

Rasheed, M. H., Rasheed, M. S., & Farooq, R. (2024). The interplay of ownership, governance, and capital structures with firm performance: Insights from the manufacturing sector in Pakistan. UW Journal of Management Sciences, 8(1), 69–84.

Richardson, G., Lanis, R., & Taylor, G. (2015). Financial distress, outside directors and corporate tax aggressiveness spanning the global financial crisis: An empirical analysis. Journal of Banking & Finance, 52, 112–129. https://doi.org/10.1016/j.jbankfin.2014.11.013

Saragih, A. H., & Ali, S. (2023). Corporate tax risk: A literature review and future research directions. Management Review Quarterly, 73(2), 527–577. https://doi.org/10.1007/s11301-021-00251-8

Wang, F., Xu, S., Sun, J., & Cullinan, C. P. (2020). Corporate tax avoidance: A literature review and research agenda. Journal of Economic Surveys, 34(4), 793–811. https://doi.org/10.1111/joes.12347

Whiteside, H. (2023). Beyond death and taxes: Fiscal studies and the fiscal state. Environment and Planning A: Economy and Space, 55(7), 1744–1761. https://doi.org/10.1177/0308518X21993125

Yermack, D. (1996). Higher market valuation of companies with a small board of directors. Journal of Financial Economics, 40(2), 185–211. https://doi.org/10.1016/0304-405X(95)00844-5

Zahra, A., Nasir, N., Rahman, S. U., & Idress, S. (2023). Impact of exchange rate, and foreign direct investment on external debt: Evidence from Pakistan using ARDL cointegration approach. IRASD Journal of Economics, 5(1), 52–62. https://doi.org/10.52131/joe.2023.0501.0110

Zmijewski, M. E. (1984). Methodological issues related to the estimation of financial distress prediction models. Journal of Accounting Research, 22, 59–82. https://doi.org/10.2307/2490859

Copyright (c) 2025 Zahid Maqbool, Muhammad Haroon Rasheed, Salma Sadiq

This work is licensed under a Creative Commons Attribution 4.0 International License.

Authors retain copyright and grant the journal right of first publication with the work simultaneously licensed under a Creative Commons Attribution (CC-BY) 4.0 License that allows others to share the work with an acknowledgement of the work’s authorship and initial publication in this journal.