Nexus between Financial Reporting Fraud and Delegated Investments: Mediating role of Emotions and Delegated Investments Decisions

Abstract

Abstract Views: 0

Abstract Views: 0

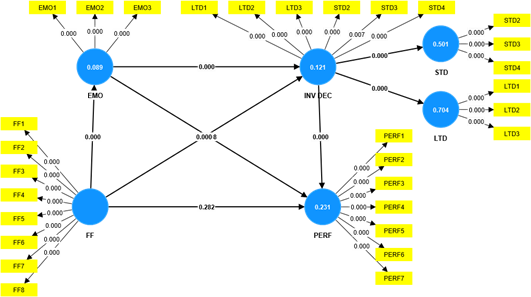

Financial reporting fraud is an important area of study in finance. However, reporting this fraud encounters new challenges with the changes in time and the state of affairs. Hence, this study is envisioned to investigate the mediating role of emotions and investment decisions in between financial reporting fraud and the performance of investment professionals under the delegated investment mechanism. The research is based on the responses collected through a self-administered questionnaire from 248 investment professionals in Pakistan selected through judgmental sampling. The proposed relationship was analyzed through the application of Partial Least Square Structure Equation Modeling (PLS-SEM) by using Smart PLS 4. The study discovered the full mediation of both emotions and short- and long-term investment decisions in the relationship between financial reporting fraud and investment performance. Cognizant to the fact that emotions and investment decisions mediate between fraudulent financial reporting and the performance of investment professionals; real investors may have a better understanding about who to hire to manage their investments. A well-selected competitive professional, at one end, is expected to safeguard the investors’ interest in the times of crises. While, at the other end, these professionals would bring economic stability by strengthening the investors’ trust on the financial market mechanisms as a result of their resilient professional support.

Downloads

References

Abdulshakour, S. (2020). Impact of financial statements on financial decision-making. Open Science Journal, 5(2), 1–31. https://doi.org/10.23954/osj.v5i2.2260

Agbaje, W. H., & Oloruntoba, S. R. (2018). An assessment of impact of financial statement fraud on profit performance of manufacturing firm in Nigeria: A study of food and beverage firms in Nigeria. European Journal of Business and Management, 10(9), 1–16.

Ahmad, M. (2021). Does underconfidence matter in short-term and long-term investment decisions? Evidence from an emerging market. Management Decision, 59(3), 692–709. https://doi.org/10.1108/MD-07-2019-0972

Akinadewo, I., Al-Amen, S., Dagunduro, M., & Akinadewo, J. (2023). Empirical assessment of the effect of financial reporting components on investment decisions of small and medium enterprises in Nigeria. Archives of Business Research, 11(9), 30–49. https://doi.org/10.14738/abr.119.15449

Amahalu, N, N., & Chinyere, O. (2020). Effect of financial statement quality on investment decisions of quoted deposit money banks in Nigeria. International Journal of Management Studies and Social Science Research, 2, 99–109.

Amalia, D. R., & Triwacananingrum, W. (2022). The disclosure effect of sustainability reporting and financial statements on investment efficiency: Evidence in Indonesia. Indonesian Journal of Sustainability Accounting and Management, 6(1), 82–93. https://doi.org/10.28992/ijsam.v6i1.512

Angela, W., & Aryancana, R. (2017). The effect of financial reporting quality on financing and investment. Etikonomi, 16(1), 81–92. https://doi.org/10.15408/etk.v16i1.4600

Ardianto, H., Harymawan, I., Paramitasari, Y., & Nasih, M. (2020). Financial reporting quality and investment efficiency: Evidence from Indonesian stock market. Economics and Finance in Indonesia, 66(2), 112–122. https://doi.org/10.47291/efi.v66i2.702

Attah, M., & Jindal, P. (2017). Impact of misstatement in financial statements on investment decision making. International Journal of Scientific and Research Publications, 7(5), 145–150.

Bagozzi, R., & Yi, Y. (1988). On the evaluation of structural equation models. Journal of the Academy of Marketing Science, 16(1), 74–94. https://doi.org/10.1007/BF02723327

Bamidele, M., Ibrahim, J., & Omole, I. (2018). Financial reporting quality and its effect on investment decisions by Nigerian deposit money banks. European Journal of Accounting, Auditing and Finance Research, 6(4), 23–34.

Begum, R., & Siddiqui, D. A. (2024). Corporate social responsibility disclosures & delegated investment decisions: The role of religiosity. International Journal of Social Science and Entrepreneurship, 4(2), 111–138. https://doi.org/10.58661/ijsse.v4i2.270

Berthilde, M., & Rusibana, C. (2020). Financial statement analysis and investment decision making in commercial banks: A case of bank of Kigali, Rwanda. Journal of Financial Risk Management, 9, 355–376. https://doi.org/10.4236/jfrm.2020.94019

BioCatch. (2024). AI, fraud & financial crime survey: AI's role in perpetrating and fighting financial crime. https://www.biocatch.com/ai-fraud-financial-crime-survey

Bokhari, U., Sulehri, F. A., Hassan, N., & Aziz, B. (2023). Impact of allied factors on investment performance, mediating role of investment decision: Evidence from investors in Lahore. Journal of Education and Social Studies, 4(1), 27–46. https://doi.org/10.52223/jess.20234103

Brundin, E., & Gustafsson, V. (2013). Entrepreneurs’ decision making under different levels of uncertainty: the role of emotions. International Journal of Entrepreneurial Behaviour & Research, 19(6), 568–591. https://doi.org/10.1108/IJEBR-07-2012-0074

Chin, W. W. (1998). Issues and opinion on structural equation modeling. MIS Quarterly, 8(2), 7–16.

Christian, N., & Basri, Y. (2019). Analysis of fraud triangle, fraud diamond and fraud pentagon theory to detecting corporate fraud in Indonesia. The International Journal of Business Management and Technology, 3(4), 1–6.

Connelly, B., Certo, S., Ireland, R., & Reutzel, C. (2011). Signaling Theory: A review and assessment. Journal of Management, 37(1), 39–67. https://doi.org/10.1177/0149206310388419

Cressey, D. R. (1953). Other people's money: A study of the social psychology of embezzlement. Free Press.

Davidson, R., Pirinsky, C., & Zhang, H. (2021). Financial reporting fraud and delegated investment. http://dx.doi.org/10.2139/ssrn.3763194

Ebaid, I. S. (2023). Board characteristics and the likelihood of financial statements fraud: Empirical evidence from an emerging market. Future Business Journal, 9(47), 1–12. https://doi.org/10.1186/s43093-023-00218-z

Elwisam, Muhani, Ria, Digdowiseiso, K., Kartini, Juliandi, D., & Saputra, D. (2024). Implementation of signaling theory in financial management: A bibliometric analysis. RGSA – Revista de Gestão Social e Ambiental, 18(3), 1–13. https://doi.org/10.24857/rgsa.v18n3-092

Fairbank, J., Labianca, G., Steensma, H., & Metters, R. (2006). Information processing design choices, strategy, and risk management performance. Journal of Management Information Systems, 23(1), 293–319. http://dx.doi.org/10.2753/MIS0742-1222230110

Fornell, C., & Larcker, D. (1981). Evaluating structural equation models with unobservable variables and measurement error. Journal of Marketing Research, 18(1), 39–50.

Gefen, D., Straub, D., & Boudreau, M.-C. (2000). Structural equation modeling and regression: Guidelines for research practice. Communications of the Association for Information Systems, 4(7), 1–77. https://doi.org/10.17705/1CAIS.00407

Gill, S., Khurshid, M. K., Mahmood, S., & Ali, A. (2018). Factors effecting investment decision making behavior: The mediating role of information searches. European Online Journal of Natural and Social Sciences, 7(4), 758–767.

Haidari, M. N. (2023). Impact of decision-making on investment performance: A comprehensive analysis. Journal of Asian Development Studies, 12(4), 980–990. https://doi.org/10.62345/jads.2023.12.4.78

Henseler, J., Ringle, C., & Sarstedt, M. (2015). A new criterion for assessing discriminant validity in variance-based structural equation modeling. Journal of the Academy of Marketing Science, 43, 115–135. https://doi.org/10.1007/s11747-014-0403-8

Hulland, J. (1999). Use of partial least squares (pls) in strategic management research: A review of four recent studies. Strategic Management Journal, 20, 195–204. https://doi.org/10.1002/(SICI)1097-0266(199902)20:2<195::AID-SMJ13>3.0.CO;2-7

International Auditing and Assurance Standards Board. (2023, October 13). Handbook of international quality management, auditing, review, other assurance, and related services pronouncements. https://www.iaasb.org/publications/2022-handbook-international-quality-management-auditing-review-other-assurance-and-related-services

Irfan, M., Adeel, R., & Malik, M. S. (2023). The impact of emotional finance, and market knowledge and investor protection on investment performance in stock and real estate markets. SAGE Open, 13(4), 1–18. https://doi.org/10.1177/21582440231206900

Isa, T. (2011). Impacts and losses caused by the fraudulent and manipulated financial information on economic decisions. Review of International Comparative Management, 12(5), 929–939.

Jin, L., Taffler, R., Eshraghi, A., & Tosun, O. (2019). Fund manager conviction and investment performance. International Review of Financial Analysis, 71, 1–15. https://doi.org/10.1016/j.irfa.2020.101550

Kapellas, K., & Siougle, G. (2017). Financial reporting practices and investment decisions: A review of the literature. Industrial Engineering & Management, 6(4), 1–9. https://doi.org/10.4172/2169-0316.1000235

Kawugana, A., Johnson, A., & Ade, F. A. (2019). Role of financial statement in investment decision making. International Journal of Management Science Entrepreneurship, 9(5), 123–139.

Koech, A., Cheboi, J., & Koske, N. (2020). Mediating effect of investment decisions between overconfidence heuristic and financial‐performance of small, and medium enterprises in Nairobi, Kenya. Journal of Business Management and Economic Research, 4(2), 186–198. https://doi.org/10.29226/TR1001.2020.193

Le, H., Lai, C.-P., Phan, V., & Pham, V. (2024). Financial reporting quality and investment efficiency in manufacturing firms: The role of firm characteristics in an emerging market. Journal of Competitiveness, 16(1), 62–78. https://doi.org/10.7441/joc.2024.01.04

Lerner, J., Li, Y., Valdesolo, P., & Kassam, K. (2015). Emotion and decision making. Annual Review of Psychology, 66(1), 799–823. https://doi.org/10.1146/annurev-psych-010213-115043

Marks, J. (2012, June 17–22). The mind behind the fraudsters crime: Key behavioral and environmental elements [Discussion Session]. 23rd ACFE Global Fraud Conference, Orlando, The USA.

Maulidiana, S., & Triandi, T. (2019). Analysis of fraudulent financial reporting through the fraud pentagon theory. Advances in Economics, Business and Management Research, 143, 214–219. https://doi.org/10.2991/aebmr.k.200522.042

Mayfield, C., Perdue, G., & Wooten, K. (2008). Investment management and personality type. Financial Services Review, 17, 219 –236. https://doi.org/1057-0810/08/$

Mesioye, O., & Bakare, I. (2024). Evaluating financial reporting quality: metrics, challenges, and impact on decision-making. International Journal of Research Publication and Reviews, 5(10), 1144–1156. https://doi.org/10.55248/gengpi.5.1024.2735

Mohammed, A., Abubakar, H., & Lawal, M. D. (2016). The effects of financial reporting on investment decision making by banks In Nigeria. International Journal of Research in Finance and Marketing, 6(4), 21–51

Okike, E. (2011). Financial reporting and fraud. In S. Idowu & C. Louche (Eds.), Theory and practice of corporate social responsibility (pp. 229–262). Springer.

Omidi, M., Min, Q., Moradinaftchali, V., & Piri, M. (2019). The efficacy of predictive methods in financial statement fraud. Discrete Dynamics in Nature and Society, 2019 (1), 1–12. https://doi.org/10.1155/2019/4989140

Safiq, M., & Seles, W. (2018, August 8–9). The effects of external pressures, financial targets and financial distress on financial statement fraud [Paper presentation]. 5th Annual International Conference on Accounting Research (AICAR 2018), Manado, Indonesia.

Sander, J. C. (2024). The role of emotions in investment decisions: The effects of vividness of a crowdfunding campaign video [Master’s thesis, Leopold-Franzens-Universität Innsbruck]. -Universität Innsbruck Repository. https://digital.obvsg.at/9479661

Shahzad, F., & Rehman, I. (2019). The influence of financial reporting quality and audit quality on investment efficiency: Evidence from Pakistan. International Journal of Accounting & Information Management, 27(4), 600–614. http://dx.doi.org/10.1108/IJAIM-08-2018-0097

Shakespeare, C. (2020). Reporting Matters: The real effects of financial reporting on investing and financing decisions. Accounting and Business Research, 50(5), 425–442. https://doi.org/10.1080/00014788.2020.1770928

Song, C., Pan, D., Ayub, A., & Cai, B. (2024). The interplay between financial literacy, financial risk tolerance, and financial behaviour: The moderator effect of emotional intelligence. Psychology Research and Behavior Management, 16, 535–548. https://doi.org/10.2147/PRBM.S398450

Spence, M. (1973). Job market signaling. The Quarterly Journal of Economics, 87(3), 355–374. https://doi.org/10.2307/1882010

Sutejo, B. S., Sumiati, Wijayanti, R., & Ananda, C. F. (2023, March 15–16). Five basic human emotions and investment decisions on generation Z in Surabaya-Indonesia [Paper presentation]. Proceedings of the 20th International Symposium on Management (INSYMA 2023), Bangkok, Thailand. https://doi.org/10.2991/978-94-6463-244-6_3

Xin, Q., Zhou, J., & Hu, F. (2018). The economic consequences of financial fraud: Evidence from the product market in China. China Journal of Accounting Studies, 6(1), 1–23. https://doi.org/10.1080/21697213.2018.1480005

Zenzerović, R., & Šajrih, J. (2023). Financial statements fraud identifiers. Economic Research-Ekonomska Istraživanja, 36(3), 1–13. https://doi.org/10.1080/1331677X.2023.2218916

Zhao, X., Lynch Jr, J., & Chen, Q. (2010). Reconsidering Baron and Kenny: Myths and truths about mediation analysis. Journal of Consumer Research, 37(2), 197–206. https://doi.org/10.1086/651257

Copyright (c) 2025 Rukhshinda Begum, Danish Ahmed Siddiqui

This work is licensed under a Creative Commons Attribution 4.0 International License.

Authors retain copyright and grant the journal right of first publication with the work simultaneously licensed under a Creative Commons Attribution (CC-BY) 4.0 License that allows others to share the work with an acknowledgement of the work’s authorship and initial publication in this journal.