Exploring the Role of Fintech, Green Finance, and CSR on Environmental Performance with the Mediating Role of Green Innovation

Abstract

Abstract Views: 0

Abstract Views: 0

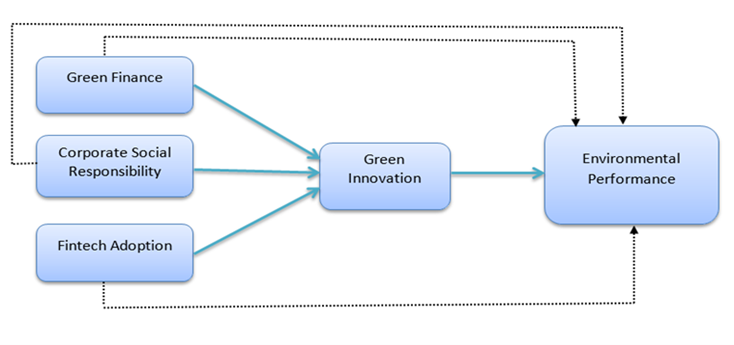

This study aims to investigate the influence of green finance, corporate social responsibility, and fintech on the environmental performance of banks in the context of sustainability. Additionally, it seeks to examine the mediating role of green innovation. Primary data was collected using convenience random sampling through a structured questionnaire from 400 respondents working in the banking sector of Pakistan. Through multiple linear regression, it was found that CSR, green finance, and fintech adoption play a significant role in driving the banks’ environmental performance. Additionally, Hayes Process showed that green innovation significantly but partially mediated these relationships. The outcomes support the resource-based theory, implying that possessing and implementing strategic resources can boost the performance of banks and extend the application of the above theory in the realm of environmental sustainability. Banks and policymakers can also benefit from the results of this research.

Downloads

References

Abbas, N., & Shahid, M. S. (2024). Mapping the impact of green finance on corporate sustainability: A bibliometric analysis. Audit and Accounting Review, 4(1), 101–130. https://doi.org/10.32350/aar.41.05

Ahmad, N., Ullah, Z., Arshad, M. Z., waqas Kamran, H., Scholz, M., & Han, H. (2021). Relationship between corporate social responsibility at the micro-level and environmental performance: The mediating role of employee pro-environmental behavior and the moderating role of gender. Sustainable Production and Consumption, 27, 1138–1148. https://doi.org/10.1016/j.spc.2021.02.034

Al-Ali, H. A., & O’Mahony, B. (2025). Corporate social responsibility and environmental performance: The mediating role of green capabilities and green innovation. Journal of Asia Business Studies, 19(4), 973–997. https://doi.org/10.1108/JABS-08-2024-0472

Ali, S., Yan, Q., Sajjad Hussain, M., Irfan, M., Ahmad, M., Razzaq, A., Dagar, V., & Işık, C. (2021). Evaluating green technology strategies for the sustainable development of solar power projects: Evidence from Pakistan. Sustainability, 13(23), Article e12997. https://doi.org/10.3390/su132312997

Ashta, A. (2023). How can fintech companies get involved in the environment? Sustainability, 15(13), Article e10675. https://doi.org/10.3390/su151310675

Asif, M., Sarwar, F., & Lodhi, R. N. (2023). Future and current research directions of FinTech: A bibliometric analysis. Audit and Accounting Review, 3(1), 19–51. https://doi.org/10.32350/aar.31.02

Aslam, W., & Jawaid, S. T. (2023). Green banking adoption practices: Improving environmental, financial, and operational performance. International Journal of Ethics and Systems, 39(4), 820–840. https://doi.org/10.1108/IJOES-06-2022-0125

Badrous, Y. M. L., Tawfik, O. I., Elmaasrawy, H. E., Srour, M. I., & Sharaf, M. A. A. (2025). Fintech adoption and commercial banks’ environmental performance: Do green accounting practices matter? International Journal of Financial Studies, 13(2), Article e90. https://doi.org/10.3390/ijfs13020090

Bai, R., & Lin, B. (2022). Access to credit and green innovation: Do green finance and digitalization levels matter? Journal of Global Information Management (JGIM), 30(1), 1–21. https://doi.org/10.4018/JGIM.315022

Barney, J. (1991). Firm resources and sustained competitive advantage. Journal of Management, 17(1), 99–120. https://doi.org/10.1177/01492063910170010

Bartlett, M. (1935). Some aspects of the time-correlation problem in regard to tests of significance. Journal of the Royal Statistical Society, 98(3), 536–543. https://doi.org/10.2307/2342284

Bimha, A., & Nhamo, G. (2017). Measuring environmental performance of banks: Evidence from Carbon Disclosure Project (CPD) reporting banks. Journal of Economic and Financial Sciences, 10(1), 26–46. https://doi.org/10.4102/jef.v10i1.3

Bruna, M. G., & Lahouel, B. B. (2022). CSR & financial performance: Facing methodological and modeling issues commentary paper to the eponymous FRL article collection. Finance Research Letters, 44, Article e102036. https://doi.org/10.1016/j.frl.2021.102036

Cao, J., Law, S. H., Samad, A. R. B. A., Mohamad, W. N. B. W., Wang, J., & Yang, X. (2021). Impact of financial development and technological innovation on the volatility of green growth—evidence from China. Environmental Science and Pollution Research, 28(35), 48053–48069. https://doi.org/10.1007/s11356-021-13828-3

Chen, J., Siddik, A. B., Zheng, G.-W., Masukujjaman, M., & Bekhzod, S. (2022). The effect of green banking practices on banks’ environmental performance and green financing: An empirical study. Energies, 15(4), Article e1292. https://doi.org/10.3390/en15041292

Chen, Y.-S., Lai, S.-B., & Wen, C.-T. (2006). The influence of green innovation performance on corporate advantage in Taiwan. Journal of Business Ethics, 67, 331–339. https://doi.org/10.1007/s10551-006-9025-5

Dai, X., Siddik, A. B., & Tian, H. (2022). Corporate social responsibility, green finance and environmental performance: Does green innovation matter? Sustainability, 14(20), Article e13607. https://doi.org/10.3390/su142013607

Desai, R., & Patel, S. (2025). Analysing the research development in green finance: Performance analysis and directions for future research. FIIB Business Review, 14 (1), Article e23197145241306838. https://doi.org/10.1177/23197145241306838

Desalegn, G., & Tangl, A. (2022). Enhancing green finance for inclusive green growth: A systematic approach. Sustainability, 14(12), Article e7416. https://doi.org/10.3390/su14127416

Dong, X., & Yu, M. (2023). Does FinTech development facilitate firms' innovation? Evidence from China. International Review of Financial Analysis, 89, Article e102805. https://doi.org/10.1016/j.irfa.2023.102805

Dwivedi, P., Alabdooli, J. I., & Dwivedi, R. (2021). Role of FinTech adoption for competitiveness and performance of the bank: A study of banking industry in UAE. International Journal of Global Business and Competitiveness, 16(2), 130–138. https://doi.org/10.1007/s42943-021-00033-9

Gazi, M. A. I., Hossain, M. M., Islam, S., Al Masud, A., Amin, M. B., Senathirajah, A. R. b. S., & Abdullah, M. (2025). Effect of corporate social responsibility on sustainable environmental performance: Mediating effects of green capability and green transformational leadership; moderating effects of top management environmental concern and perceived organizational support. Environment, Development and Sustainability, 1–34. https://doi.org/10.1007/s10668-025-06082-x

Gidage, M. K., & Bhide, S. (2024). Does ESG impact the financial well-being of companies?: Evidence from India. In Emerging perspectives on financial well-being (pp. 74–94). IGI Global Scientific Publishing.

Guang-Wen, Z., & Siddik, A. B. (2022). Do corporate social responsibility practices and green finance dimensions determine environmental performance? An Empirical Study on Bangladeshi Banking Institutions. Frontiers in Environmental Science, 10, Article e890096. https://doi.org/10.3389/fenvs.2022.890096

Hu, Y., & Zheng, J. (2021). Is green credit a good tool to achieve “double carbon” goal? Based on coupling coordination model and PVAR model. Sustainability, 13(24), Article e14074. https://doi.org/10.3390/su132414074

Indriastuti, M., & Chariri, A. (2021). The role of green investment and corporate social responsibility investment on sustainable performance. Cogent Business & Management, 8(1), Article e1960120. https://doi.org/10.1080/23311975.2021.1960120

Klassen, R. D., & Whybark, D. C. (1999). The impact of environmental technologies on manufacturing performance. Academy of Management journal, 42(6), 599–615. https://doi.org/10.5465/256982

Kraus, S., Rehman, S. U., & García, F. J. S. (2020). Corporate social responsibility and environmental performance: The mediating role of environmental strategy and green innovation. Technological Forecasting and Social Change, 160, Article e120262. https://doi.org/10.1016/j.techfore.2020.120262

Lisha, L., Mousa, S., Arnone, G., Muda, I., Huerta-Soto, R., & Shiming, Z. (2023). Natural resources, green innovation, fintech, and sustainability: A fresh insight from BRICS. Resources Policy, 80, Article e103119. https://doi.org/10.1016/j.resourpol.2022.103119

Liu, J., Jiang, Y., Gan, S., He, L., & Zhang, Q. (2022). Can digital finance promote corporate green innovation? Environmental Science and Pollution Research, 29(24), 35828–35840. https://doi.org/10.1007/s11356-022-18667-4

Liu, L. (2024). Green innovation, firm performance, and risk mitigation: Evidence from the USA. Environment, Development and Sustainability, 26(9), 24009–24030. https://doi.org/10.1007/s10668-023-03632-z

Naz, S., Asif, M., & Hameed, S. (2023). Fintech's role in sustainable banking performance: Are green banking policies driving sustainability in pakistan's banking system? Gomal University Journal of Research, 39(3), 294–312.

Nkansah, B. K. (2018). On the Kaiser-Meier-Olkin’s measure of sampling adequacy. Mathematical Theory and Modeling, 8(7), 52–76.

Rehman, A., Ullah, I., Afridi, F.-e.-A., Ullah, Z., Zeeshan, M., Hussain, A., & Rahman, H. U. (2021). Adoption of green banking practices and environmental performance in Pakistan: A demonstration of structural equation modelling. Environment, Development and Sustainability, 23(9), 13200–13220. https://doi.org/10.1007/s10668-020-01206-x

Riyanti, R. S., Wulandari, P., Prijadi, R., & Tortosa-Ausina, E. (2025). Green loans: Navigating the path to sustainable profitability in banking. Economic Analysis and Policy, 85, 1613–1624. https://doi.org/10.1016/j.eap.2025.01.028

Sadiq, M., Paramaiah, C., Dong, Z., Nawaz, M. A., & Shukurullaevich, N. K. (2024). Role of fintech, green finance, and natural resource rents in sustainable climate change in China. Mediating role of environmental regulations and government interventions in the pre-post COVID eras. Resources Policy, 88, Article e104494. https://doi.org/10.1016/j.resourpol.2023.104494

Sajid, R., Ayub, H., Malik, B. F., & Ellahi, A. (2023). The role of fintech on bank risk‐taking: Mediating Role of bank’s operating efficiency. Human Behavior and Emerging Technologies, 2023(1), Article e7059307. https://doi.org/10.1155/2023/7059307

Subanidja, S., Sorongan, F., & Legowo, M. B. (2022). Sustainable bank performance antecedents in the covid-19 pandemic era: A conceptual model. Emerging Science Journal, 6(4), 786–797. https://doi.org/10.28991/ESJ-2022-06-04-09

Talha, M. (2023). Green financing and sustainable policy for low carbon and energy saving initiatives: Turning educational institutes of China into green. Engineering Economics, 34(1), 103–117. https://doi.org/10.5755/j01.ee.34.1.32837

Tan, Y., Lin, B., & Wang, L. (2025). Green finance and corporate environmental performance. International Review of Economics & Finance, 98, Article e103929. https://doi.org/10.1016/j.iref.2025.103929

Turker, D. (2009). Measuring corporate social responsibility: A scale development study. Journal of Business Ethics, 85(4), 411–427. https://doi.org/10.1007/s10551-008-9780-6

Wang, Q.-J., Wang, H.-J., & Chang, C.-P. (2022). Environmental performance, green finance and green innovation: What's the long-run relationships among variables? Energy Economics, 110, Article e106004. https://doi.org/10.1016/j.eneco.2022.106004

Wang, Y., & Zhi, Q. (2016). The role of green finance in environmental protection: Two aspects of market mechanism and policies. Energy Procedia, 104, 311–316. https://doi.org/10.1016/j.egypro.2016.12.053

Xu, N., Huo, B., & Ye, Y. (2024). The impact of supply chain pressure on cross-functional green integration and environmental performance: An empirical study from Chinese firms. Operations Management Research, 17(2), 612–634. https://doi.org/10.1007/s12063-024-00439-7

Xu, S. (2025). Corporate social responsibility and financialization: Is CSR used as a financial tool? European Management Review. https://doi.org/10.1111/emre.70013

Xue, Q., Bai, C., & Xiao, W. (2022). Fintech and corporate green technology innovation: Impacts and mechanisms. Managerial and Decision Economics, 43(8), 3898–3914. https://doi.org/10.1002/mde.3636

Yan, C., Siddik, A. B., Yong, L., Dong, Q., Zheng, G.-W., & Rahman, M. N. (2022). A two-staged SEM-artificial neural network approach to analyze the impact of FinTech adoption on the sustainability performance of banking firms: the mediating effect of green finance and innovation. Systems, 10(5), Article e148. https://doi.org/10.3390/systems10050148

Yu, C.-H., Wu, X., Zhang, D., Chen, S., & Zhao, J. (2021). Demand for green finance: Resolving financing constraints on green innovation in China. Energy policy, 153, Article e112255. https://doi.org/10.1016/j.enpol.2021.112255

Yuan, X. (2025). Integrating Fintech, CSR, and green finance: impacts on financial and environmental performance in China. Humanities and Social Sciences Communications, 12(1), 1–15. https://doi.org/10.1057/s41599-025-05064-8

Zheng, G.-W., Siddik, A. B., Masukujjaman, M., & Fatema, N. (2021). Factors affecting the sustainability performance of financial institutions in Bangladesh: the role of green finance. Sustainability, 13(18), Article e10165. https://doi.org/10.3390/su131810165

Copyright (c) 2025 Fareeha Waseem, Veera Salman, Zahra Batool

This work is licensed under a Creative Commons Attribution 4.0 International License.

Authors retain copyright and grant the journal right of first publication with the work simultaneously licensed under a Creative Commons Attribution (CC-BY) 4.0 License that allows others to share the work with an acknowledgement of the work’s authorship and initial publication in this journal.