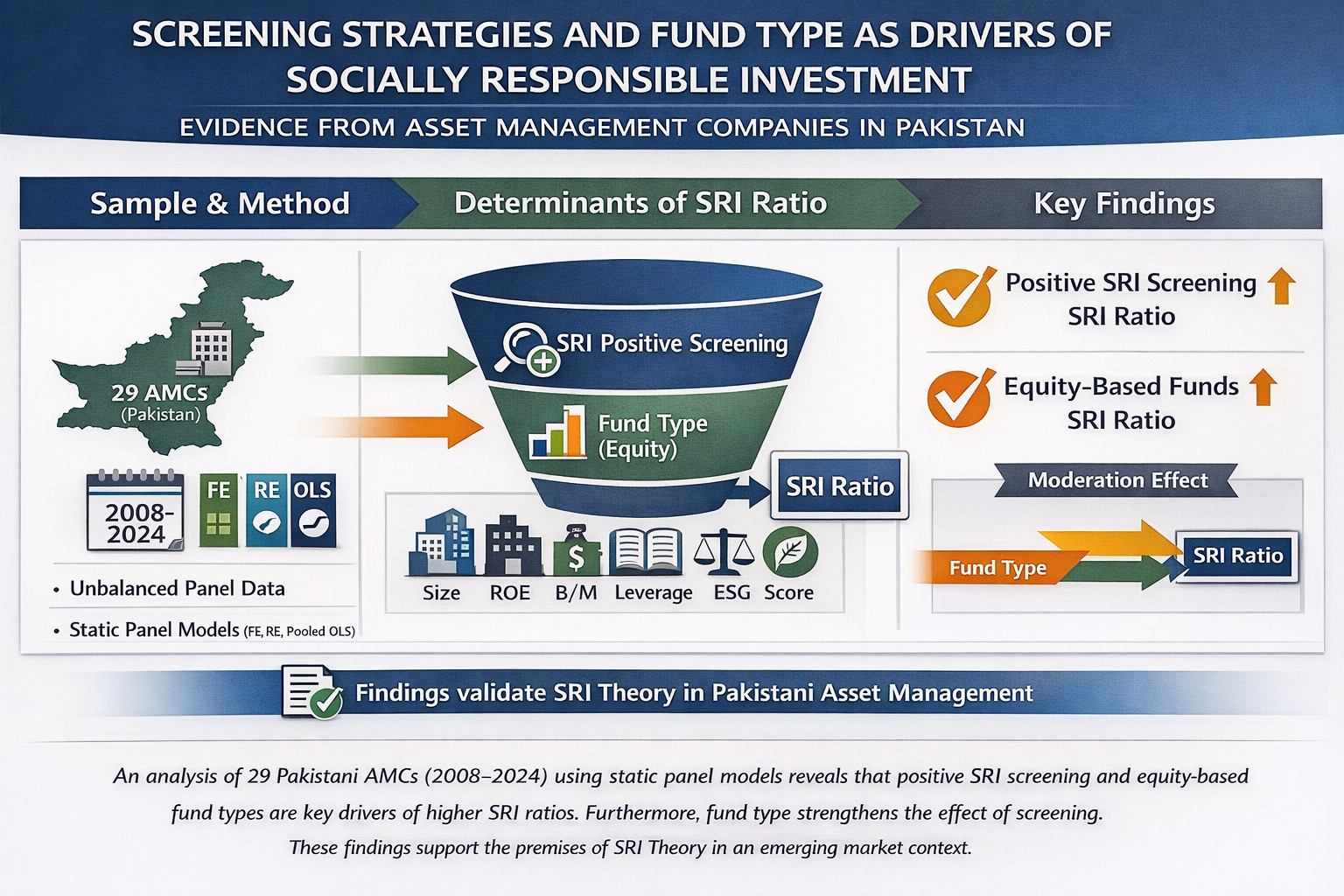

Screening Strategies and Fund Type as Drivers of Socially Responsible Investment: Evidence from Asset Management Companies in Pakistan

Abstract

Abstract Views: 0

Abstract Views: 0

There has been a strong surge of socially responsible investment (SRI), globally. However, the adoption of such initiatives remains under investigated in the financial institutions (FIs) of vulnerable economies (e.g., Pakistan). More specifically, such contexts lack empirical evidence regarding the impact of screening strategies and fund type on SRI adoption. Therefore, the current research examines these factors for asset management companies (AMCs) as sampled FIs in Pakistan. For this purpose, unbalanced panel data (2008-2024) of 29 AMCs from Pakistan is collected. The estimation methods include static panel techniques such as fixed effects (FE), random effects (RE), and pooled ordinarily least square (OLS). The outcome variable is SRI ratio, while the input variables are SRI screening and fund types. Similarly, the control variables include firm size, return on equity (ROE), book to market (B/M) ratio, leverage, and environmental, social, and governance (ESG) score. The results indicate that positive screening and equity-based funds play a critical role in enhancing the SRI ratio in Pakistani AMCs. Moreover, fund type strengthens the impact of positive screening on SRI ratio for such AMCs. The findings related to positive screening and equity-based fund type support the application of the SRI theory. This result highlights a number of practical implications for regulators and fund managers in FIs. For example, policymakers should consider positive screening and promote equity-based SRI funds in their FIs. Finally, the findings of this study are novel due to addressing the problem in the under-examined context of a vulnerable economy like Pakistan.

Downloads

References

Akomea-Frimpong, I., Adeabah, D., Ofosu, D., & Tenakwah, E. J. (2022). A review of studies on green finance of banks, research gaps and future directions. Journal of Sustainable Finance & Investment, 12(4), 1241–1264. https://doi.org/10.1080/20430795.2020.1870202

Alda, M. (2021). The environmental, social, and governance (ESG) dimension of firms in which social responsible investment (SRI) and conventional pension funds invest: The mainstream SRI and the ESG inclusion. Journal of Cleaner Production, 298, Article e126812. https://doi.org/https://doi.org/10.1016/j.jclepro.2021.126812

Amy, S. W. L., Marcus, R., Thurai Murugan, N., Md. Abdur, R., & Abdullah, A.-M. (2023). The relationship between the quality of sustainability reporting and corporate financial performance: A cross-sectional and longitudinal study. Australasian Accounting, Business and Finance Journal, 17(2), 38–60. https://doi.org/10.14453/aabfj.v17i2.04

Aydoğmuş, M., Gülay, G., & Ergun, K. (2022). Impact of ESG performance on firm value and profitability. Borsa Istanbul Review, 22, S119–S127. https://doi.org/https://doi.org/10.1016/j.bir.2022.11.006

Badía, G., Ferruz, L., & Cortez, M. C. (2021). The performance of social responsible investing from retail investors' perspective: international evidence. International Journal of Finance & Economics, 26(4), 6074–6088. https://doi.org/https://doi.org/10.1002/ijfe.2109

Baltagi, B. H., & Hashem Pesaran, M. (2007). Heterogeneity and cross section dependence in panel data models: theory and applications introduction. Journal of Applied Econometrics, 22(2), 229–232. https://doi.org/https://doi.org/10.1002/jae.955

Beisenbina, M., Fabregat-Aibar, L., Barberà-Mariné, M.-G., & Sorrosal-Forradellas, M.-T. (2023). The burgeoning field of sustainable investment: Past, present and future. Sustainable Development, 31(2), 649–667. https://doi.org/https://doi.org/10.1002/sd.2422

Bhatia, M., Mehrotra, V., & Thawani, B. (2023). Firm Characteristics and Adoption of Integrated Reporting: An Emerging Market Perspective. Global Business Review, 24. 09721509231160872. https://doi.org/10.1177/09721509231160872

Birindelli, G., & Palea, V. (2023). To green or not to green? How CSR mechanisms at the governance level affect the likelihood of banks pursuing green product strategies. Corporate Governance: The International Journal of Business in Society, 23(1), 219–242. https://doi.org/10.1108/CG-09-2021-0349

Bolibok, P. M. (2024). Does firm size matter for ESG risk? Cross-Sectional evidence from the banking industry. Sustainability, 16(2), Article e679. https://doi.org/10.3390/su16020679

Cardillo, G., & Harasheh, M. (2023). Stay close to me: What do ESG scores tell about the deal timing in M&A transactions? Finance Research Letters, 51, Article e103498. https://doi.org/https://doi.org/10.1016/j.frl.2022.103498

Coelho, R., Jayantilal, S., & Ferreira, J. J. (2023). The impact of social responsibility on corporate financial performance: A systematic literature review. Corporate Social Responsibility and Environmental Management, 30(4), 1535–1560. https://doi.org/https://doi.org/10.1002/csr.2446

Daugaard, D., Jia, J., & Li, Z. (2023). Implementing corporate sustainability information in socially responsible investing: A systematic review of empirical research. Journal of Accounting Literature, 46(2), 238–276. https://doi.org/10.1108/JAL-12-2022-0127

Dowling, J., & Pfeffer, J. (1975). Organizational legitimacy: Social values and organizational behavior. Pacific Sociological Review, 18(1), 122–136. https://doi.org/10.2307/1388226

Ferrat, Y., Daty, F., & Burlacu, R. (2021). Short- and long-term effects of responsible investment growth on equity returns. The Journal of Risk Finance, 23(1), 1–13. https://doi.org/10.1108/JRF-07-2021-0107

Friedman, R. (1984). Strategic management: A stakeholder perspective. Englewood Cliffs, NJ: Prentice Hall, 50.

Fu, C., Lu, L., & Pirabi, M. (2023). Advancing green finance: A review of sustainable development. Digital Economy and Sustainable Development, 1(1), Article e20. https://doi.org/10.1007/s44265-023-00020-3

Gangi, F., Varrone, N., & Daniele, L. M. (2021). Socially responsible investment (SRI): From niche to mainstream. In F. Gangi, A. Meles, L. M. Daniele, N. Varrone, & D. Salerno (Eds.), The Evolution of Sustainable Investments and Finance: Theoretical Perspectives and New Challenges (pp. 1–58). Springer International Publishing. https://doi.org/10.1007/978-3-030-70350-9_1

Global Sustainable Investment Alliance (GSIA). (2025). Global Sustainable Investment Review 2024. https://www.gsi-alliance.org/wp-content/uploads/2025/11/GSIR-2024-Main-Report.pdf

Haini, H. (2020). Examining the relationship between finance, institutions and economic growth: Evidence from the ASEAN economies. Economic Change and Restructuring, 53(4), 519–542. https://doi.org/10.1007/s10644-019-09257-5

Helliar, C., Petracci, B., & Tantisantiwong, N. (2022). Comparing SRI funds to conventional funds using a PCA methodology. Journal of Asset Management, 23(7), 581–595. https://doi.org/10.1057/s41260-022-00264-2

Hoepner, A. G. F., & Schopohl, L. (2020). State pension funds and corporate social responsibility: Do beneficiaries’ political values influence funds’ investment decisions? Journal of Business Ethics, 165(3), 489–516. https://doi.org/10.1007/s10551-018-4091-z

Hornuf, L., & Yüksel, G. (2024). The performance of socially responsible investments: A meta-analysis. European Financial Management, 30(2), 1012–1061. https://doi.org/https://doi.org/10.1111/eufm.12439

Jaiswal, R., Gupta, S., & Tiwari, A. K. (2025). Environmental, social and governance-type investing: A multi-stakeholder machine learning analysis. Management Decision. https://doi.org/10.1108/MD-04-2024-0930

Jarrett, U., Mohaddes, K., & Mohtadi, H. (2019). Oil price volatility, financial institutions and economic growth. Energy Policy, 126, 131–144. https://doi.org/https://doi.org/10.1016/j.enpol.2018.10.068

Minhas, A. S., Maqsood, N., Shahid, T. A., & Rehman, A. U. (2024). Investment performance in green finance: Assessing the impact of environmental social and governance integration. iRASD Journal of Economics, 6(1), 27 – 44. https://doi.org/10.52131/joe.2024.0601.0192

Mohammad, K. U., Hussain, M. M., & Adnan, N. U. H. (2025). Risk-taking channel of monetary policy and the role of ESG and political instability: evidence from South Asia. International Economics and Economic Policy, 22(3), Article e49. https://doi.org/10.1007/s10368-025-00674-8

Narula, R., Rao, P., Kumar, S., & Paltrinieri, A. (2025). ESG investing & firm performance: Retrospections of past & reflections of future. Corporate Social Responsibility and Environmental Management, 32(1), 1096–1121. https://doi.org/https://doi.org/10.1002/csr.2982

Naseer, M. M., Guo, Y., Bagh, T., & Zhu, X. (2024). Sustainable investments in volatile times: Nexus of climate change risk, ESG practices, and market volatility. International Review of Financial Analysis, 95, Article e103492. https://doi.org/https://doi.org/10.1016/j.irfa.2024.103492

Oehmke, M., & Opp, M. M. (2025). A theory of socially responsible investment. The Review of Economic Studies, 92(2), 1193–1225. https://doi.org/10.1093/restud/rdae048

Olaniyi, C. O., & Adedokun, A. (2022). Finance-institution-growth trilogy: Time-series insights from South Africa. International Journal of Emerging Markets, 17(1), 120–144. https://doi.org/10.1108/IJOEM-05-2019-0370

Pasquino, M., & Lucarelli, C. (2024). Socially responsible investments inside out: A new conceptual framework for investigating retail investor preferences. International Journal of Bank Marketing, 43(3), 449–475. https://doi.org/10.1108/IJBM-02-2024-0077

Principles of Responsible Investment (PRI). (2024). Sustainable Financial System. PRI https://www.unpri.org/sustainability-issues/sustainable-markets/sustainable-financial-system

Rao, S. (2019). The philosophical paradigm of financial market contagion research. International Journal of Management Concepts and Philosophy, 12(3), 278–295. https://doi.org/10.1504/IJMCP.2019.100677

Sahu, A., Pahi, D., Dwibedi, P., Mishra, A. P., & Mishra, B. (2025). Examining the role of ESG disclosure and firm characteristics in promoting global green building adoption: A panel probit approach. Socio-Ecological Practice Research, 7(1), 77–91. https://doi.org/10.1007/s42532-024-00209-6

Sangomla, A. (2022, November 15). COP27: Climate vulnerable countries, G7 launch plan for quick loss and damage funding. Down to Earth. https://www.downtoearth.org.in/climate-change/cop27-climate-vulnerable-countries-g7-launch-plan-for-quick-loss-and-damage-funding-85979

Siedschlag, I., & Yan, W. (2023). Do green investments improve firm performance? Empirical evidence from Ireland. Technological Forecasting and Social Change, 186, Article e122181. https://doi.org/https://doi.org/10.1016/j.techfore.2022.122181

Soratana, K. (2025). Environmental factors in ESG investing. In M. Bednárová & K. Soratana (Eds.), Environmental, Social, and Governance (ESG) Investment and Reporting (pp. 17–42). Springer Nature Switzerland. https://doi.org/10.1007/978-3-031-84235-1_2

Tampakoudis, I., Kiosses, N., & Petridis, K. (2023). The impact of mutual funds’ ESG scores on their financial performance during the COVID-19 pandemic. A data envelopment analysis. Corporate Governance, 23(7), 1457–1483. https://doi.org/10.1108/CG-12-2022-0491

Tosun, O. K., & Moon, S. K. (2025). Socially responsible investment funds and firm performance improvement. Review of Quantitative Finance and Accounting, 65(2), 539–572. https://doi.org/10.1007/s11156-024-01352-7

UN. (2024). Principles of Responsible Investment. https://www.unpri.org/sustainability-issues/environmental-social-and-governance-issues

The Vulnerable 20 (V20) Group. (2024). Members. The Vulnerable Twenty. https://www.v-20.org/members

Wahab, M. Z. B. H., Mohamed Naim, A., & Abu Hassan, M. H. (2024). Developing Islamic-sustainable and responsible investment (i-SRI) criteria based on the environmental, social and governance (ESG) concept. Journal of Islamic Accounting and Business Research. ahead of print. https://doi.org/10.1108/JIABR-12-2021-0311

Wang, H. (2024). ESG investment preference and fund vulnerability. International Review of Financial Analysis, 91, Article e103002. https://doi.org/https://doi.org/10.1016/j.irfa.2023.103002

Whited, R. L., Swanquist, Q. T., Shipman, J. E., & Moon, J. R., Jr. (2022). Out of control: The (Over) use of controls in accounting research. The Accounting Review, 97(3), 395–413. https://doi.org/10.2308/TAR-2019-0637

Yao, S., Pan, Y., Sensoy, A., Uddin, G. S., & Cheng, F. (2021). Green credit policy and firm performance: What we learn from China. Energy Economics, 101, Article e105415. https://doi.org/https://doi.org/10.1016/j.eneco.2021.105415

Yu, Z., Farooq, U., Alam, M. M., & Dai, J. (2024). How does environmental, social, and governance (ESG) performance determine investment mix? New empirical evidence from BRICS. Borsa Istanbul Review, 24(3), 520–529. https://doi.org/https://doi.org/10.1016/j.bir.2024.02.007

Zheng, Z., Li, X., Han, X., Shi, D., & Liu, J. (2025). Better green financial instrument: Government green fund and corporate new energy technology innovation. Energy Economics, 143, Article e108234. https://doi.org/https://doi.org/10.1016/j.eneco.2025.108234

Copyright (c) 2025 Zahid Bashir, Muhammad Aamir, Muhammad Sabeeh Iqbal

This work is licensed under a Creative Commons Attribution 4.0 International License.

Authors retain copyright and grant the journal right of first publication with the work simultaneously licensed under a Creative Commons Attribution (CC-BY) 4.0 License that allows others to share the work with an acknowledgement of the work’s authorship and initial publication in this journal.