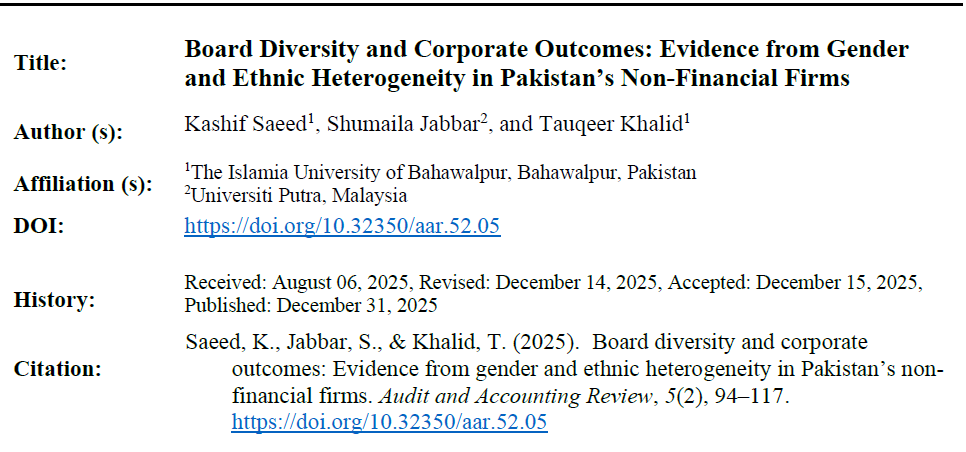

Board Diversity and Corporate Outcomes: Evidence from Gender and Ethnic Heterogeneity in Pakistan’s Non-Financial Firms

Abstract

Abstract Views: 0

Abstract Views: 0

This study examines how gender and ethnic diversity in corporate boards shape the financial performance, innovation capacity, and decision-making efficiency of non-financial firms listed on the Pakistan Stock Exchange (PSX). Using panel data for 310 firms over the period 2015-2023, the analysis employs the System-GMM estimator to address concerns about unobserved heterogeneity, dynamic persistence, and endogeneity inherent in corporate governance research. Both board gender diversity and ethnic diversity exhibit positive and significant effects on return on assets (ROA), return on equity (ROE), and firm innovation, indicating that diverse boards enhance strategic perspectives and access to resources. However, the benefits of gender diversity weaken in firms with highly concentrated ownership, suggesting that dominant shareholders may limit board influence. The results highlight the importance of inclusive governance in settings characterized by institutional constraints and cultural fragmentation. By providing empirical evidence from an emerging economy, the study contributes to the growing literature on board diversity. It offers guidance to regulators and corporate leaders seeking to strengthen governance quality and enhance firm competitiveness in emerging market environments.

Downloads

References

Ain, Q. U., Yuan, X., & Javaid, H. M. (2022). The impact of board gender diversity and foreign institutional investors on firm innovation: Evidence from China. European Journal of Innovation Management, 25(3), 813–837. https://doi.org/10.1108/EJIM-10-2020-0439

Akter, A., Yusoff, W. F. W., & Abdul-Hamid, M. A. (2024). The moderating role of board diversity on the relationship between ownership structure and real earnings management. Asian Journal of Accounting Research, 9(2), 98–115. https://doi.org/10.1108/AJAR-10-2022-0307

Amin, H. M., Mohamed, E. K., Abdallah, A. S., & Elamer, A. A. (2025). National culture, formal institutions and structure of board of directors: Theory and empirical evidence. Journal of Financial Reporting and Accounting. Advanced online publication. https://doi.org/10.1108/JFRA-07-2024-0431

Arellano, M., & Bover, O. (1995). Another look at the instrumental variable estimation of error-components models. Journal of Econometrics, 68(1), 29–51. https://doi.org/10.1016/0304-4076(94)01642-D

Barney, J. B. (1991). Firm resources and sustained competitive advantage. Journal of Management, 17(1), 99–120. https://doi.org/10.1177/014920639101700108

Batool, N., Saleem, Q., & Abbas, Z. (2022). The effect of board diversity on firm performance: Evidence from non-financial firms listed in Pakistan Stock Exchange. Journal of Legal, Ethical and Regulatory Issues, 25(5), 1–14.

Blundell, R., & Bond, S. (1998). Initial conditions and moment restrictions in dynamic panel data models. Journal of Econometrics, 87(1), 115–143. https://doi.org/10.1016/S0304-4076(98)00009-8

Campos-García, V., & Zúñiga-Vicente, J. Á. (2023). Board gender diversity and employee productivity: Non-linear effects. European Research on Management and Business Economics, 30(1), Article e100236. https://doi.org/10.1016/j.iedeen.2024.100236

Cox, T. H., & Blake, S. (1991). Managing cultural diversity: Implications for organizational competitiveness. Academy of Management Executive, 5(3), 45–56. https://doi.org/10.5465/ame.1991.4274465

Eissa, A. M., Hamdy, A., & Diab, A. (2024). Governmental ownership, board gender diversity, and ESG performance: Evidence from an emerging market. Sustainability, 16(16), Article e6963. https://doi.org/10.3390/su16166963

Hambrick, D. C., & Mason, P. A. (1984). Upper echelons: The organization as a reflection of its top managers. Academy of Management Review, 9(2), 193–206. https://doi.org/10.5465/amr.1984.4277628

Ibrahim, R. L., Al-Mulali, U., Ajide, K. B., Mohammed, A., & Al-Faryan, M. A. S. (2023). The implications of food security on sustainability: Do trade facilitation, population growth, and institutional quality make or mar the target for SSA? Sustainability, 15(3), Article e2089. https://doi.org/10.3390/su15032089

Jensen, M. C., & Meckling, W. H. (1976). Theory of the firm: Managerial behaviour, agency costs, and ownership structure. Journal of Financial Economics, 3(4), 305–360. https://doi.org/10.1016/0304-405X(76)90026-X

Kabara, A. S., Khatib, S. F. A., & Bazhair, A. (2022). The effect of board educational and gender diversity on firm performance: Evidence from non-financial firms. Sustainability, 14(17), Article e11058. https://doi.org/10.3390/su141711058

Khan, I., Khan, I., Khan, I. U., Suleman, S., & Ali, S. (2023). Board diversity from a resource-based view perspective: New evidence from Pakistan. International Journal of Productivity and Performance Management, 73(3), 649–675. https://doi.org/10.1108/IJPPM-01-2022-0055

Latif, M. A., Javed, A., Rooh, S., & Malik, M. F. (2025). Does the fifth industrial revolution and corporate governance matter? An investigation of the top 100 PSX companies. Journal of Asian Development Studies, 14(2), 717–732. https://doi.org/10.62345/jads.2025.14.2.56

Mirza, N. I., Malik, Q. A., & Mahmood, C. K. (2020). The value of board diversity in corporate governance and investment decisions of Pakistani firms. Journal of Open Innovation: Technology, Market, and Complexity, 6(4), Article e146. https://doi.org/10.3390/joitmc6040146

Nazliben, K. K., Renneboog, L., & Uduwalage, E. (2024). Social diversity on corporate boards in a country torn by civil war. Journal of Business Ethics, 194(3), 679–706. https://doi.org/10.1007/s10551-024-05624-z

Park, S. H., Zhang, Y., & Keister, L. A. (2020). Governance innovations in emerging markets. Academy of Management Perspectives, 34(2), 226–239. https://doi.org/10.5465/amp.2017.0177

Pernamasari, R. (2025). Does board gender diversity enhance ESG performance? Journal of Contemporary Accounting, 7(1), Article e3. https://doi.org/10.20885/jca.vol7.iss1.art3

Roodman, D. (2009). A note on the theme of too many instruments. Oxford Bulletin of Economics and Statistics, 71(1), 135–158. https://doi.org/10.1111/j.1468-0084.2008.00542.x

Securities and Exchange Commission of Pakistan. (2025). Corporate governance code reforms: Enhancing board diversity and sustainability reporting. https://www.secp.gov.pk

Shinnie, X. (2024). Multicultural embeddedness: Chinese experience of entrepreneurial 'breakout' in a superdiverse and transnational city of Birmingham (Doctoral dissertation, Birmingham City University). Birmingham City University. https://www.open-access.bcu.ac.uk/id/eprint/15319

Tajfel, H., & Turner, J. C. (1979). An integrative theory of intergroup conflict. In W. G. Austin & S. Worchel (Eds.), The social psychology of intergroup relations (pp. 33–47). Brooks/Cole.

Torchia, M., & Solarino, A. (2025). Gender, ethnic and nationality board diversity and firm performance: A meta-analysis. Corporate Governance: The International Journal of Business in Society. Advanced online publication. https://doi.org/10.1108/CG-08-2023-0332

United Nations Development Programme. (2023). UNDP annual report 2023: Advancing sustainable development in a changing world. https://www.undp.org/publications/undp-annual-report-2023

Wang, A. (2025). A general diagnostic of the normal approximation in GMM models. The Econometrics Journal, 28(2), 261–275. https://doi.org/10.1093/ectj/utaf005

World Economic Forum. (2023). Global gender gap report 2023. https://www.weforum.org/publications/global-gender-gap-report-2023/

Copyright (c) 2025 Kashif Saeed, Shumaila Jabbar, Tauqeer Khalid

This work is licensed under a Creative Commons Attribution 4.0 International License.

Authors retain copyright and grant the journal right of first publication with the work simultaneously licensed under a Creative Commons Attribution (CC-BY) 4.0 License that allows others to share the work with an acknowledgement of the work’s authorship and initial publication in this journal.