Quality of Audit and Financial Markets: Evidence from South Asian Economies

Abstract

Abstract Views: 0

Abstract Views: 0

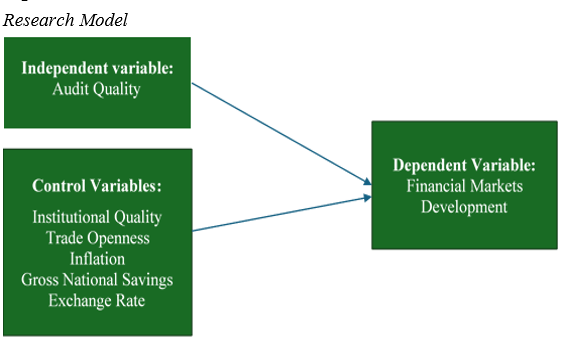

We study the impact of Quality of Audit (QA) on Financial Markets (FM) in a group of South Asian Economies (SAEs) using panel dataset collected from World Economic Forum’s Global Competitive Index reports from 2006 to 2020. We estimated fixed effect regression as baseline model, and robustness is performed using robust fixed effect, Driscoll Kraay and PCSE, which are capable of correcting standard error issues associated with fixed effect regression. The results document a positive and significant role of QA in boosting FM in our sample. The study findings support the argument that QA may provide accurate and translucent financial reporting, lessen the asymmetry of information, and develop the confidence of investors. Investor confidence builds with transparent information which not only increases the investment opportunities but also increases the liquidity and stability of financial markets of SAEs. Improved QA helps to reduce the incidents of financial frauds and misstatements, and makes financial statements more reliable and trustworthy. Both domestic and international investors rely on audited financial statements, and it helps them make investment decisions, so it is the need of the businesses to enhance audit practices. The study has several limitations including the sample, the period tested, and data source. The results have implications for private and public institutes of SAEs, policymakers, government bodies, and financial institutions of SAEs, to apply for financial development. In our information, this is the foremost study investigating the direct effect of QA on FM in SAEs, and our results are robust across alternative estimators.

Downloads

References

Achim, A. M. (2018). The strength of auditing and reporting standards in relation to financial reporting quality. SEA – Practical Application of Science, 6(17), 193–197.

Al-Ahdal, W. M., & Hashim, H. A. (2021). Impact of audit committee characteristics and external audit quality on firm performance: Evidence from India. Corporate Governance: The International Journal of Business in Society, 22(2), 424–445. https://doi.org/10.1108/CG-09-2020-0420

Alawi, S. M., Abbassi, W., Saqib, R., & Sharif, M. (2022). Impact of financial innovation and institutional quality on financial development in emerging markets. Journal of Risk and Financial Management, 15(3), Article e115. https://doi.org/10.3390/jrfm15030115

Alfaro, L., Chanda, A., Kalemli-Ozcan, S., & Sayek, S. (2004). FDI and economic growth: The role of local financial markets. Journal of International Economics, 64(1), 89–112. https://doi.org/10.1016/S0022-1996(03)00081-3

Alfraih, M. M. (2016). The role of audit quality in firm valuation: Evidence from an emerging capital market with a joint audit requirement. International Journal of Law and Management, 58(5), 575–598. https://doi.org/10.1108/IJLMA-09-2015-0049

Almarayeh, T. S., Aibar-Guzmán, B., & Abdullatif, M. (2020). Does audit quality influence earnings management in emerging markets? Evidence from Jordan. Revista de Contabilidad-Spanish Accounting Review, 23(1), 64–74. https://doi.org/10.6018/rcsar.365091

Alsmady, A. A. (2022). Quality of financial reporting, external audit, earnings power and companies performance: The case of Gulf Corporate Council countries. Research in Globalization, 5, Article 100093. https://doi.org/10.1016/j.resglo.2022.100093

Alzeban, A. (2019). An examination of the impact of compliance with internal audit standards on financial reporting quality: Evidence from Saudi Arabia. Journal of Financial Reporting and Accounting, 17(3), 498–518. https://doi.org/10.1108/JFRA-09-2018-0085

Amara, N., Bourouis, S., Alshdaifat, S. M., Bouzgarrou, H., & Al Amosh, H. (2025). The impact of audit quality and female audit committee characteristics on earnings management: Evidence from the UK. Journal of Risk and Financial Management, 18(3), 136. https://doi.org/10.3390/jrfm18030136

Arif, I., & Rawat, A. S. (2019). Trade and financial openness and their impact on financial development. South Asian Journal of Business Studies, 8(1), 26–39. https://doi.org/10.1108/SAJBS-06-2018-0063

Arnold, B. V., & De Lange, P. A. (2004). Enron: An examination of agency problems. Critical Perspectives on Accounting, 15(6–7), 751–765. https://doi.org/10.1016/j.cpa.2003.08.005

Bayar, Y. (2014). Financial development and domestic savings in emerging Asian countries. Theoretical and Applied Economics, 7(596), 55–66.

Beisland, L. A., Mersland, R., & Strøm, R. Ø. (2015). Audit quality and corporate governance: Evidence from the microfinance industry. International Journal of Auditing, 19(3), 218–237. https://doi.org/10.1111/ijau.12041

Black, E. L., & Carnes, T. A. (2006). Analysts’ forecasts in Asia‐Pacific markets: The relationship among macroeconomic factors, accounting systems, bias, and accuracy. International Journal of Accounting, Auditing and Performance Evaluation, 3(3), 208–227. https://doi.org/10.1111/j.1467-646X.2006.00127.x

Bond, P., Edmans, A., & Goldstein, I. (2012). The real effects of financial markets. Annual Review of Financial Economics, 4(1), 339–360. https://doi.org/10.1146/annurev-financial-110311-101826

Boolaky, P. K., Krishnamurti, C., & Hoque, A. (2013). Determinants of the strength of auditing and reporting standards: A cross-country study. Australasian Accounting, Business and Finance Journal, 7(4), 17–36. https://doi.org/10.14453/aabfj.v7i4.3

Budisantoso, T., & Kurniawan, H. (2022). The contagion effect of decreasing audit quality on financial statement audit engagement: The Indonesian case. Asia-Pacific Journal of Business Administration, 16(1), 63–76. https://doi.org/10.1108/APJBA-11-2020-0393

Chafai, A., Khémiri, W., Tobar, R., Attia, E. F., & Abozeid, H. O. (2024). The moderating effect of audit quality on the relationship between financial inclusion and corporate investment: New evidence from the Middle East and North Africa region. Cogent Economics & Finance, 12(1), Article 2378121. https://doi.org/10.1080/23322039.2024.2378121

Francis, J. R., Khurana, I. K., & Pereira, R. (2003). The role of accounting and auditing in corporate governance and the development of financial markets around the world. Asia-Pacific Journal of Accounting & Economics, 10(1), 1–30. https://doi.org/10.1080/16081625.2003.10510613

Francis, J. R., Pinnuck, M. L., & Watanabe, O. (2014). Auditor style and financial statement comparability. The Accounting Review, 89(2), 605–633. https://doi.org/10.2308/accr-50642

Gao, P., & Zhang, G. (2019). Auditing standards, professional judgment, and audit quality. The Accounting Review, 94(6), 201–225. https://doi.org/10.2308/accr-52389

Gerayli, M., Rezaei Pitenoei, Y., & Abdollahi, A. (2021). Do audit committee characteristics improve financial reporting quality in emerging markets? Evidence from Iran. Asian Review of Accounting, 29(2), 251–267. https://doi.org/10.1108/ARA-10-2020-0155

Haque, N. U. (1997). Financial market reform in Pakistan. The Pakistan Development Review, 36(4), 839–854.

Hayes, A. (2022). Financial markets: Role in the economy, importance, types, and examples. Investopedia. https://www.investopedia.com/terms/f/financial-market.asp

Huq, M. T., & Ichihashi, M. (2025). Can historical economic growth patterns be traced in South and Southeast Asian countries as the classical theory suggests? Journal of Economic Structures, 14(1), Article e11. https://doi.org/10.1186/s40008-025-00355-4

Hussien, L., Zraqat, O., Zureigat, Q., Al-Rawashdeh, H. A., Alrawashedh, N., Almutairi, A., & Alrashidi, M. (2024). The Impact of Audit Quality on Reducing Earnings Management Practices in the Jordanian Industrial Companies. In A. Hamdan & U. Braendle (Eds.), Harnessing AI, machine learning, and IoT for intelligent business: Volume 2 (pp. 569–578). Springer Nature Switzerland. https://doi.org/10.1007/978-3-031-47210-0_50

Jameel, S. Z. M., Al-Sendy, A. M., & Hamoudi, K. M. T. (2024). The impact of audit characteristics on earnings management: Evidence from Dubai banks. Journal of Risk and Financial Management, 17(6), Article e249. https://doi.org/10.3390/jrfm17060249

Jensen, M. C., & Meckling, W. H. (1976). Theory of the firm: Managerial behavior, agency costs and ownership structure. Journal of Financial Economics, 3(4), 305–360. https://doi.org/10.1016/0304-405X(76)90026-X

Karaibrahimoğlu, Y. Z., & Çangarlı, B. G. (2016). Do auditing and reporting standards affect firms’ ethical behaviours? The moderating role of national culture. Journal of Business Ethics, 139(1), 55–75. https://doi.org/10.1007/s10551-015-2571-y

Khelil, I., Guidara, A., & Khlif, H. (2023). The effect of the strength of auditing and reporting standards on infrastructure quality in Africa: Do ethical behaviour of firms and judicial independence matter? Journal of Financial Management of Property and Construction, 28(1), 145–160. https://doi.org/10.1108/JFMPC-02-2021-0017

Khlif, H., & Guidara, A. (2018). Quality of management schools, strength of auditing and reporting standards and tax evasion. EuroMed Journal of Business, 13(2), 149–162. https://doi.org/10.1108/EMJB-05-2017-0017

Myers, S. C., & Majluf, N. S. (1984). Corporate financing and investment decisions when firms have information that investors do not have. Journal of Financial Economics, 13(2), 187–221. https://doi.org/10.1016/0304-405X(84)90023-0

Naseer, M. M., Khan, M. A., Popp, J., & Oláh, J. (2021). Firm, industry and macroeconomics dynamics of stock returns: A case of Pakistan non-financial sector. Journal of Risk and Financial Management, 14(5), Article e190. https://doi.org/10.3390/jrfm14050190

Olaniyi, C. O., & Oladeji, S. I. (2021). Moderating the effect of institutional quality on the finance–growth nexus: Insights from West African countries. Economic Change and Restructuring, 54(1), 43–74. https://doi.org/10.1007/s10644-020-09275-8

Pagano, M. (1993). Financial markets and growth: An overview. European Economic Review, 37(2–3), 613–622. https://doi.org/10.1016/0014-2921(93)90051-B

Quoc, T. N. K., Le Van, T., Minh, H. N., & Ngoc, O. N. T. (2024). Financial statements’ reliability affects firms’ performance: A case of Vietnam. Journal of Eastern European and Central Asian Research, 11(1), 143–155. https://doi.org/10.15549/jeecar.v11i1.1066

Sarbanes–Oxley Act of 2002, Pub. L. No. 107-204, 116 Stat. 745 (2002).

Sattar, U., Javeed, S. A., & Latief, R. (2020). How audit quality affects firm performance with the moderating role of product market competition: Empirical evidence from Pakistani manufacturing firms. Sustainability, 12(10), Article e4153. https://doi.org/10.3390/su12104153

Shi, H., Wen, W., Zhou, G., & Zhu, X. (2021). Do individual auditors have their own styles? Evidence from clients’ financial statement comparability in China. Accounting Horizons, 35(3), 187–215. https://doi.org/10.2308/HORIZONS-18-002

Stiglitz, J. E. (1993). The role of the state in financial markets. The World Bank Economic Review, 7(Suppl. 1), 19–52. https://doi.org/10.1093/wber/7.suppl_1.19

van de Walle, S. (2006). The state of the world’s bureaucracies. Journal of Comparative Policy Analysis: Research and Practice, 8(4), 437–448. https://doi.org/10.1080/13876980600971409

Wang, Y. (2025). Audit quality, board independence, and investment decisions: empirical evidence from emerging markets. Applied Economics, 1-15.

World Economic Forum. (2024). The global competitiveness report 2024. World Economic Forum. https://www.weforum.org/

Yang, C.-H., & Huang, Y.-J. (2009). Do intellectual property rights matter to Taiwan’s exports? A dynamic panel approach. The World Economy, 32(3), 555–578. https://doi.org/10.1111/j.1468-0106.2009.00460.x

Yi, W., & Yang, Q. (2024). The influence of ESG performance on corporate value: An empirical analysis of Chinese A-share listed sports companies. SAGE Open, 14(2), Article e21582440241249892. https://doi.org/10.1177/21582440241249892

Copyright (c) 2025 Danish Ali, Waiza Nisar, Muhammad Asif Khan

This work is licensed under a Creative Commons Attribution 4.0 International License.

Authors retain copyright and grant the journal right of first publication with the work simultaneously licensed under a Creative Commons Attribution (CC-BY) 4.0 License that allows others to share the work with an acknowledgement of the work’s authorship and initial publication in this journal.