Price Volatility and Financial Performance: Assessing the Impact of Food Prices on Pakistan’s Industrial Sector

Abstract

Abstract Views: 0

Abstract Views: 0

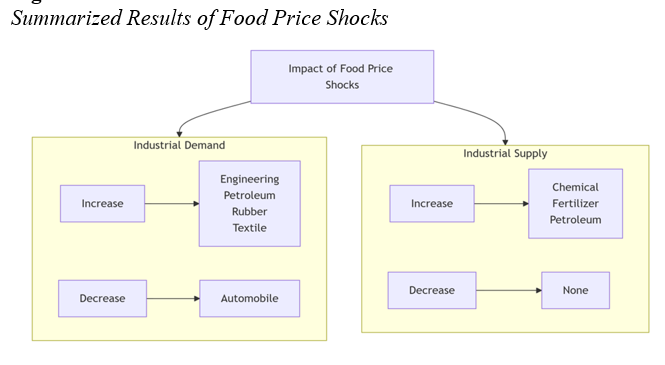

Food is a necessity for human survival, and food price volatility has the potential to affect household consumption patterns and, as a result, it affects the manufacturing decisions of various firms. This study aims to address this dimension of food price volatility, and it examines how it affects the financial performance of the manufacturing sector through its demand and supply channels. It employs the SVAR Model to examine these impacts for monthly time series data from June 2008 to June 2023. The study revealed that for some industries, like engineering, petroleum, rubber, and textiles, food prices lead to an increase in demand. These results show a contradiction to the general consumer behavior theory. However, for the automobile industry, this theory holds firm, as food price shocks reduce the demand for automobiles. For industries like fertilizers, which are the input-providing industry for food production, a positive food price shock boosts the supply. This study addresses a novel dimension of the effect of food price shocks, and goes beyond examining its impact on aggregate inflation, providing a policy guideline to relevant stakeholders for accurate analysis of the impact of these shocks. It will help to address the stability issues of the manufacturing sector of Pakistan and economic development and stability.

Downloads

References

Asian Development Bank. (2008). Food prices and inflation in developing Asia: Is poverty reduction coming to an end? Asian Development Bank.

Bonilla-Cedrez, C., Chamberlin, J., & Hijmans, R. J. (2021). Fertilizer and grain prices constrain food production in sub-Saharan Africa. Nature Food, 2(10), 766–772. https://doi.org/10.1038/s43016-021-00370-1

Dardeer, M. & Shaheen, R. (2025). Structural determinants of food price inflation and food security implications: Evidence from GCC panel data. Humanities and Social Sciences Communications, 12, Article e1877. https://doi.org/10.1057/s41599-025-06148-1

Dehghan, M., Moosavi, S. N., & Zare, E. (2024). Analyzing the impact of government subsidies on household welfare during economic shocks: A case study of Iran. Bio-based and Applied Economics, 13(4), 387–396. https://doi.org/10.36253/bae-15105

Duru, S., Çelik, H., Hayran, S., & Gül, A. (2024). The relationship between food prices and non-raw material inputs: Evidence from VAR analysis. International Journal of Economics, Management and Accounting, 32(1), 203–216. https://doi.org/10.31436/ijema.v32i1.1187

Engström, F., & Eriksson, C. (2023). Impact of increased grocery prices on households: Studying Sweden 2022/2023 (Master’s Thesis). KTH Royal Institute of Technology. https://kth.diva-portal.org/smash/record.jsf?pid=diva2:1773264

Fadhilah, E. F., & Ayu, S. F. (2020, February). The effect of food commodity price fluctuations on inflation in Pematang Siantar City. In IOP Conference Series: Earth and Environmental Science (Vol. 454, No. 1, p. 012019). IOP Publishing. https://doi.org/10.1088/1755-1315/454/1/012019

Garzon, A. J., & Hierro, L. A. (2021). Asymmetries in the transmission of oil price shocks to inflation in the eurozone. Economic Modelling, 105, Article e105665. https://doi.org/10.1016/j.econmod.2021.105665

Government of Pakistan, Ministry of Finance. (2023). Inflation (Chapter 7). In Pakistan Economic Survey 2022-23. Government of Pakistan. https://finance.gov.pk/survey/chapters_23/07_Inflation.pdf

Hendriks, S., de Groot Ruiz, A., Acosta, M. H., Baumers, H., Galgani, P., Mason-D’Croz, D., & Watkins, M. (2023). The true cost of food: A preliminary assessment. In Science and innovations for food systems transformation (pp. 581-601). Cham: Springer International Publishing. https://doi.org/10.1007/978-3-031-15703-5_32

Israel, K. E., & Charity, G. (2024). Food inflation and the Nigerian economy: An empirical investigation. International Journal of Research and Innovation in Social Science, 8(11), 3455–3465. https://doi.org/10.47772/IJRISS.2024.8110266

Jordan, S., & Phillips, A. Q. (2018). Dynamic simulation and testing for single-equation cointegrating and stationary autoregressive distributed models. The R Journal, 10(2), 469–488. https://doi.org/10.32614/RJ-2018-076

Khan, M. A., & Ahmed, A. (2014). Revisiting the macroeconomic effects of oil and food price shocks to P akistan economy: A structural vector autoregressive (SVAR) analysis. OPEC Energy Review, 38(2), 184–215. https://doi.org/10.1111/opec.12020

Kurosaki, T., & Fafchamps, M. (2002). Insurance market efficiency and crop choices in Pakistan. Journal of Development Economics, 67(2), 419–453. https://doi.org/10.1016/S0304-3878(01)00188-2

Lambert, D. K., & Miljkovic, D. (2010). The sources of variability in US food prices. Journal of Policy Modeling, 32(2), 210¬–222. https://doi.org/10.1016/j.jpolmod.2010.01.001

Lee, K., & Ni, N. (2002). On the dynamic effects of oil price shocks: A study using industry level data. Journal of Monetary Economics, 49(4), 823–852. https://doi.org/10.1016/S0304-3932(02)00114-9

Ollila, S. (2011). Consumers’ attitudes towards food prices (Doctoral Dissertation, Department of Economics and Management, University of Helsinki). University of Helsinki, 1–340. https://helda.helsinki.fi/handle/10138/28240

Poulton, C., Kydd, J., Wiggins, S., & Dorward, A. (2006). State intervention for food price stabilisation in Africa: Can it work? Food Policy, 31(4), 342–356. https://doi.org/10.1016/j.foodpol.2006.02.004

Sims, C. A. (1976). Econometric models and causal relations. American Economic Review, 66(2), 312–320.

Sims, C. A., & Zha, T. (1998). Bayesian methods for dynamic multivariate models. International Economic Review, 39(4), 949–968. https://doi.org/10.1111/1468-2354.00054

Subervie, J. (2008). The variable response of agricultural supply to world price instability in developing countries. Journal of Agricultural Economics, 59(1), 72–92. https://doi.org/10.1111/j.1477-9552.2007.00136.x

Timmer, C. P. (2010). Reflections on food crises past. Food Policy, 35(1), 1–11. https://doi.org/10.1016/j.foodpol.2009.09.002

Türken, F., & Yildirim, O. (2024). Second round effects of food prices on core inflation in Turkey. Economics and Business Review, 10(4), 32–55. https://doi.org/10.18559/ebr.2024.4.1485

Waterlander, W. E., Jiang, Y., Nghiem, N., Eyles, H., Wilson, N., Cleghorn, C., & Blakely, T. (2019). The effect of food price changes on consumer purchases: a randomised experiment. The Lancet Public Health, 4(8), e394–e405. https://doi.org/10.1016/S2468-2667(19)30105-7

Wibowo, H. E., Novanda, R. R., Ifebri, R., & Fauzi, A. (2023). Food price volatility and its implications for production and investment decisions: A review of the literature. AGRITROPICA: Journal of Agricultural Sciences, 6(1), 22–32. https://doi.org/10.31186/j.agritropica.6.1.22-32

World Bank. (2025, April 23). Pakistan’s poverty rate to stand at 42.4%. Business Recorder. https://www.brecorder.com/news/40359069/pakistans-poverty-rate-to-stand-at-42-4-world-bank/

Yousif, I. E. A. K., & Al-Kahtani, S. H. (2014). Effects of high food prices on consumption pattern of Saudi consumers: A case study of Al Riyadh city. Journal of the Saudi Society of Agricultural Sciences, 13(2), 169–173. https://doi.org/10.1016/j.jssas.2013.05.003

Zhao, H., Chang, J., Havlík, P., van Dijk, M., Valin, H., Janssens, C., & Obersteiner, M. (2021). China’s future food demand and its implications for trade and environment. Nature Sustainability, 4(12), 1042–1051. https://doi.org/10.1038/s41893-021-00784-6

Copyright (c) 2025 Humera Iram, Abida Yousaf

This work is licensed under a Creative Commons Attribution 4.0 International License.

Authors retain copyright and grant the journal right of first publication with the work simultaneously licensed under a Creative Commons Attribution (CC-BY) 4.0 License that allows others to share the work with an acknowledgement of the work’s authorship and initial publication in this journal.